Listen to the article

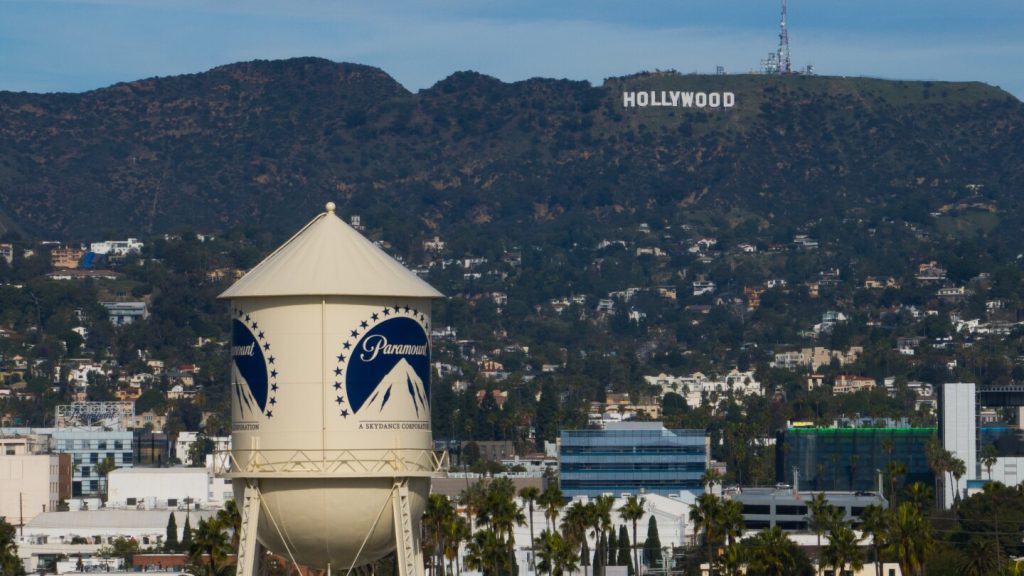

Paramount Skydance has escalated its hostile takeover attempt of Warner Bros. Discovery by announcing plans to nominate its own slate of directors ahead of the media giant’s next shareholder meeting, marking a significant intensification in one of Hollywood’s most closely watched corporate battles.

The company also filed a lawsuit Monday in Delaware Chancery Court seeking to force Warner Bros. Discovery to disclose to shareholders how it values both Paramount’s bid and a competing offer from streaming giant Netflix. This legal maneuver represents the latest attempt by Paramount to derail Warner’s preferred deal with Netflix.

Warner Bros. Discovery currently stands at the center of a high-stakes bidding war between these two entertainment powerhouses. The company’s leadership has consistently rejected advances from Skydance-owned Paramount while strongly advocating for shareholders to support Netflix’s $72 billion offer for its streaming and studio assets.

Paramount, meanwhile, has continued to press its case, recently enhancing its all-encompassing $77.9 billion offer for the entire Warner Bros. Discovery enterprise. The improved bid comes as Paramount tries to convince shareholders that its proposal represents better long-term value despite Warner’s board’s continued resistance.

Just last week, Warner Bros. Discovery’s board formally determined that Paramount’s offer “is not in the best interests of the company or its shareholders” and reiterated its recommendation for the Netflix transaction. This decisive stance has forced Paramount to pursue more aggressive tactics to win over shareholders directly.

“We do not undertake any of these actions lightly,” said David Ellison, Paramount Skydance’s chairman and CEO, in a letter to Warner Bros. Discovery shareholders on Monday. Ellison emphasized the company’s commitment to seeing its tender offer through to completion.

The proposed board nomination strategy aims to install directors more favorable to Paramount’s acquisition approach, potentially shifting control of the decision-making process. While Paramount has not yet named specific candidates for the board positions, the announcement signals a commitment to a lengthy battle if necessary.

Warner Bros. Discovery has not yet scheduled either its annual meeting or a special meeting to consider the Netflix offer, leaving timing uncertainty that Paramount appears to be leveraging in its strategy.

This corporate showdown comes amid significant transformation in the media landscape, as traditional entertainment conglomerates grapple with the shift toward streaming services and digital content consumption. The outcome could reshape the competitive dynamics of the industry for years to come.

For Warner Bros. Discovery, formed just two years ago through the merger of WarnerMedia and Discovery, the bidding war represents both a challenge and an opportunity. The company has struggled with substantial debt and integration challenges since its formation, making it an attractive acquisition target despite its valuable portfolio of content and intellectual property.

Industry analysts note that either outcome would significantly alter Hollywood’s power structure. A Netflix acquisition would dramatically expand the streaming giant’s content library and production capabilities, while a Paramount takeover would create another consolidated entertainment behemoth better positioned to compete in the evolving media ecosystem.

The tender offer process typically allows shareholders to sell their stock directly to the acquiring company, potentially circumventing board opposition. By pursuing this route alongside a board nomination strategy, Paramount is employing multiple pressure points in its campaign.

As this corporate drama continues to unfold, shareholders and industry observers are closely monitoring developments that could determine the fate of iconic entertainment brands including HBO, CNN, Warner Bros. studios, and Discovery’s extensive reality programming portfolio.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

13 Comments

The valuation discrepancy between Paramount’s and Netflix’s offers for Warner Bros. Discovery’s assets is quite significant. It will be crucial for the company’s board to thoroughly assess the long-term strategic value of each proposal.

As an investor in the mining and energy sectors, I’m closely monitoring this situation for any potential impacts on the availability of capital and resources for projects in those industries.

The legal maneuvering by Paramount to force Warner Bros. Discovery’s hand seems to be an aggressive tactic. I wonder if this could set a precedent for future hostile takeover attempts in the media industry.

This hostile takeover attempt by Paramount is a bold move. It will be interesting to see how Warner Bros. Discovery responds and whether shareholders will favor Paramount’s higher bid over Netflix’s offer.

With the media landscape rapidly evolving, these types of high-stakes corporate battles are becoming more common. It will be crucial for Warner Bros. to demonstrate the long-term value of their strategic partnership with Netflix.

This is a complex situation with significant implications for the entertainment industry. I’m curious to see how the various stakeholders, including shareholders, regulators, and the public, will weigh in on this high-stakes takeover attempt.

The commodities and energy sectors have been closely watching this battle, as the outcome could impact the availability of key resources and financing for mining and energy projects.

Diversified media conglomerates like Warner Bros. Discovery play an important role in supporting the development and distribution of content related to mining, energy, and other commodities.

The fact that Paramount is seeking to install its own slate of directors on the Warner Bros. Discovery board is a significant escalation in this corporate conflict. This move could be a game-changer.

This battle for control of Warner Bros. Discovery highlights the ongoing consolidation and power dynamics within the media and entertainment landscape. It will be interesting to see how this plays out.

As an industry observer, I’m curious to see if this takeover attempt could have any ripple effects on the financing and development of mining, energy, and commodity-related projects and content.

The outcome of this takeover battle could have far-reaching implications for the entertainment industry, as well as the broader economy and industries like mining and energy that rely on media and content.

It will be crucial for the Warner Bros. Discovery board to carefully weigh the strategic and financial merits of each offer, while also considering the potential impact on stakeholders across various sectors.