Listen to the article

The global iron ore market remained buoyant this week as Chinese steel mills continued robust purchasing despite fluctuating domestic demand signals. Prices at major ports maintained their upward trajectory, with benchmark 62% iron content fines reaching $126.40 per tonne, representing a 2.3% increase from the previous week.

Industry analysts attribute this resilience to several concurrent factors, chief among them being China’s recent infrastructure stimulus announcements. The government’s pledge to inject approximately $140 billion into various construction projects has bolstered near-term demand expectations despite broader economic concerns.

“We’re seeing Chinese mills stock up ahead of potential price increases,” said Wei Zhang, commodities strategist at Morgan Stanley. “There’s a clear disconnect between current purchasing patterns and actual downstream steel consumption, suggesting inventory building rather than immediate use.”

Brazilian mining giant Vale reported its quarterly shipments rose 4.2% year-on-year, reaching 86.3 million tonnes despite operational challenges at several key mining sites. The company maintained its annual production guidance of 310-320 million tonnes for 2023, though executives acknowledged potential headwinds from heightened environmental scrutiny.

Australia’s major producers, including Rio Tinto and BHP, have similarly posted strong export numbers, with Port Hedland shipping data showing a 5.7% increase in monthly volumes compared to the same period last year. This comes despite severe weather disruptions earlier in the quarter that temporarily hampered loading operations.

“Australian producers continue benefiting from their proximity to Asian markets and reliability as suppliers,” noted Michelle Williams, resources analyst at Macquarie Bank. “The cost advantage they maintain over competitors remains significant, especially as freight rates have increased across major shipping routes.”

The supply-demand imbalance has been further complicated by ongoing production restrictions in China’s steelmaking hubs. Environmental regulations aimed at reducing carbon emissions have forced several mills in Hebei and Jiangsu provinces to curtail production, creating localized steel shortages that support higher prices.

Market participants are closely monitoring developments in India, where exports have surged 32% in recent months. The Indian government is considering implementing additional export duties to ensure domestic supply, which could further tighten global availability.

“India’s growing role as a swing supplier has become increasingly important for global price formation,” explained Rajiv Menon, director at Steel Research Associates. “Any policy change there reverberates throughout the market, especially given current tight conditions.”

Freight costs have emerged as another significant factor influencing market dynamics. The Baltic Dry Index, which tracks shipping costs for dry bulk commodities, has climbed 18% since January, adding pressure to delivered prices for distant markets.

Meanwhile, European steel producers continue facing challenging conditions as high energy costs and sluggish construction activity constrain operations. ArcelorMittal announced temporary production cuts at two facilities in Germany, citing unsustainable operating margins amid high input costs.

Looking ahead, most analysts expect iron ore prices to moderate in the coming quarter as Chinese steel production potentially faces seasonal restrictions during winter months. However, supply-side constraints could provide a floor for prices.

“The market is walking a tightrope between softer demand expectations and persistent supply limitations,” said Katherine Brown, commodities researcher at Goldman Sachs. “While we anticipate some easing from current levels, structural support remains strong enough to prevent any significant collapse in pricing.”

Investors and industry participants will be closely watching China’s upcoming industrial production data and real estate indicators for clearer signals about medium-term demand trends, as the property sector traditionally accounts for roughly 35% of the country’s steel consumption.

The iron ore market’s resilience stands in contrast to weakening conditions in other industrial commodities, highlighting its unique supply-demand fundamentals and continued significance as a barometer for global industrial activity.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

10 Comments

Vale’s increased quarterly shipments are encouraging, though operational challenges remain. The company’s production guidance for the year suggests they’re optimistic about maintaining supply despite the headwinds.

It will be important to watch how Vale navigates these operational issues and whether they can meet their annual targets. Consistent supply is crucial for the global iron ore market.

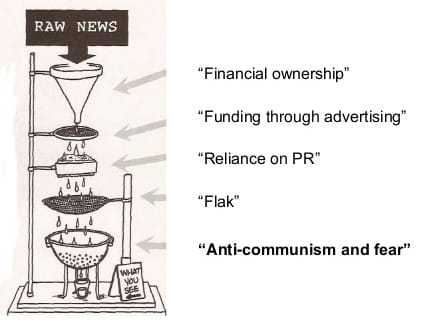

The propaganda model discussion is relevant not just for mining and commodities, but across many industries where corporate interests intersect with media coverage. It’s a valuable framework for critical thinking about information sources and biases.

Exactly. Applying this kind of analytical lens to news reporting can help readers develop a more nuanced understanding of the underlying forces shaping the narrative.

Interesting analysis on the iron ore market dynamics. It seems the Chinese government’s infrastructure stimulus is having a direct impact on demand and pricing, despite some broader economic concerns. Curious to see how this plays out in the coming months.

Agreed, the disconnect between current purchasing and actual steel consumption is notable. Inventory building ahead of potential price hikes is a strategic move by the mills.

This article highlights the complexity of the iron ore market and the various factors at play, from government policy to operational challenges. It’s a good reminder of the need for nuanced analysis when interpreting commodity news and trends.

Agreed. The interplay between macroeconomic conditions, geopolitics, and company-specific operations creates a dynamic landscape that requires careful monitoring and interpretation.

The propaganda model analysis in this article provides a thought-provoking framework for examining media coverage of mining and commodity news. Skepticism towards mainstream narratives is warranted, as corporate and political interests can shape public discourse.

Absolutely. Maintaining a critical eye on media reporting, especially around extractive industries, is essential to avoiding potential biases and distortions.