Listen to the article

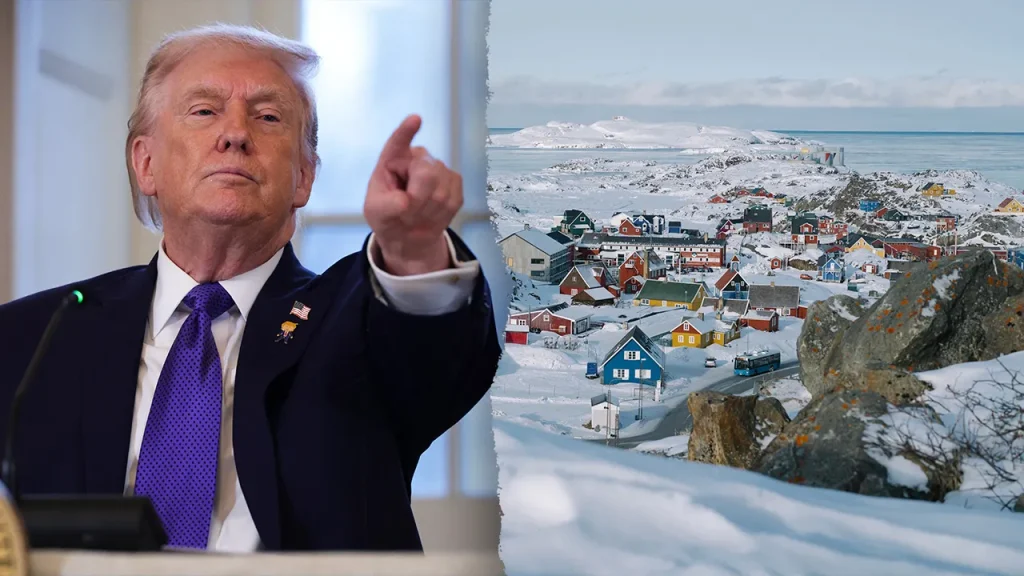

President Trump’s Greenland Acquisition Plan Could Cost $700 Billion, Faces Opposition

President Donald Trump’s renewed push for the United States to acquire Greenland could cost American taxpayers approximately $700 billion, according to recent reports. This figure, calculated by scholars and former U.S. officials involved in early planning discussions, represents more than half of the War Department’s annual budget.

The massive price tag reflects what the Trump administration has characterized as a significant national security priority. Trump himself emphasized this point in a Wednesday Truth Social post, writing: “The United States needs Greenland for the purpose of national security,” while warning that “if the U.S. does not act, Russia or China will.”

Trump has argued that control of the 800,000-square-mile Arctic territory is vital to American defense interests, particularly for the development of the “Golden Dome” missile defense system. His administration views Greenland as a strategic buffer against potential adversaries in the increasingly contested Arctic region.

However, the proposal has encountered significant resistance both domestically and internationally. A recent Reuters/Ipsos poll found that only 17% of Americans support Trump’s efforts to acquire Greenland, with 47% opposed and 35% undecided. This low level of public support comes as the initiative continues to strain relations with longstanding U.S. allies.

Denmark, which maintains sovereignty over Greenland as an autonomous territory, has strongly rejected Trump’s statements that he would acquire Greenland “one way or the other.” Danish officials, along with other NATO members, have expressed alarm at the rhetoric, warning that any military action against a NATO ally could jeopardize the entire alliance.

In a show of solidarity, troops from several European countries—including France, Germany, Sweden, and Norway—deployed to Greenland on Thursday for a two-day mission aimed at demonstrating NATO’s capacity to rapidly deploy military assets in the Arctic region. The exercise appears designed to signal European resolve in maintaining the current status quo.

Meanwhile, diplomatic efforts continue within the Trump administration. Secretary of State Marco Rubio has reportedly been tasked with developing a formal proposal to purchase Greenland, which will be presented to Trump in the coming weeks. Rubio and Vice President JD Vance are expected to meet with officials from Denmark and Greenland in Washington, D.C., on Wednesday to discuss the matter further.

Greenland itself has largely rejected U.S. overtures. With a population of approximately 56,000 people mostly residing along its ice-free coastline, Greenland’s economy relies primarily on fishing, hunting, whaling, sealing, and tourism. About 80% of the territory is covered by ice caps and glaciers.

The island has significant strategic value beyond its military positioning. Climate change is gradually revealing valuable mineral deposits, and the region’s importance as a shipping corridor is likely to increase as Arctic ice continues to recede. These factors may contribute to Trump’s interest in securing American control over the territory.

Some U.S. lawmakers have responded to the growing tensions by proposing legislation to block potential military action against NATO members, specifically in response to threats regarding Greenland’s acquisition.

As diplomatic and military maneuvers continue, the question of Greenland’s future status remains uncertain. Trump’s administration appears committed to pursuing acquisition through diplomatic channels for now, but the president’s assertion that anything less than U.S. control is “unacceptable” has raised concerns about potential escalation if negotiations fail to produce his desired outcome.

The White House has not provided additional comment on the reported $700 billion price estimate or specific plans for financing such an acquisition.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

14 Comments

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Nice to see insider buying—usually a good signal in this space.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.