Listen to the article

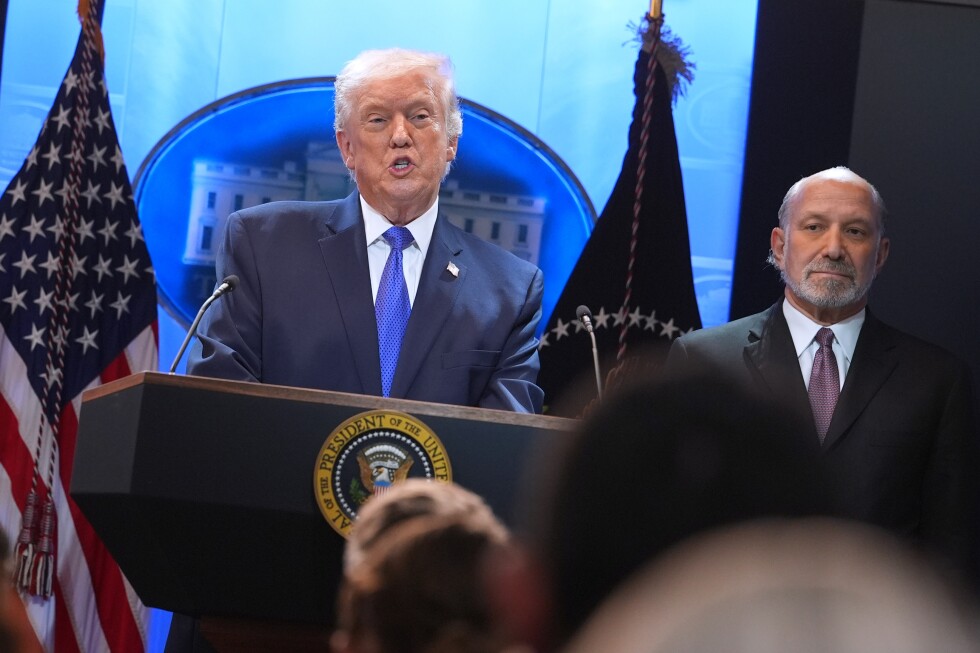

JPMorgan Chase has officially confirmed for the first time that it terminated the bank accounts of former President Donald Trump and several of his businesses following the January 6, 2021 Capitol riots, according to court documents filed this week.

The admission comes amid an ongoing legal battle between Trump and America’s largest bank. In the filing, JPMorgan’s former chief administrative officer Dan Wilkening stated, “In February 2021, JPMorgan informed Plaintiffs that certain accounts maintained with JPMorgan’s CB and PB would be closed,” referring to the bank’s commercial and private banking divisions.

This acknowledgment marks a significant development, as the bank had previously refused to directly confirm the account closures, only speaking hypothetically about its account termination policies while citing banking privacy regulations. A spokesperson for JPMorgan declined to provide additional comments beyond the legal filings.

Trump initiated the lawsuit in Florida state court, seeking $5 billion in damages. He alleges the bank closed his accounts for political reasons, causing substantial disruption to his business operations. The recent filings are part of JPMorgan’s strategy to transfer the case to federal court and change the jurisdiction to New York, where the accounts were based and where Trump maintained most of his business activities until recently.

In his original complaint, Trump accused the financial institution of trade libel and violating both state and federal unfair and deceptive trade practices laws. The lawsuit claims Trump attempted to address the issue directly with CEO Jamie Dimon after receiving account termination notices. According to Trump, Dimon promised to investigate the matter but never followed up.

The former president’s legal team further alleges that JPMorgan placed Trump and his companies on a reputational “blacklist” that both JPMorgan and other financial institutions use to prevent clients from opening future accounts. Trump’s lawyers have yet to clearly define what this blacklist entails, prompting JPMorgan’s legal team to state, “If and when Plaintiffs explain what they mean by this ‘blacklist,’ JPMorgan will respond accordingly.”

While JPMorgan has acknowledged the account closures, the bank maintains that Trump’s lawsuit lacks merit.

The case highlights the increasingly contentious issue of “debanking” – when financial institutions close customer accounts or refuse to provide banking services. Once a relatively obscure financial practice, debanking has become highly politicized in recent years, with conservative politicians arguing that banks have discriminated against them and their affiliated interests.

“In a devastating concession that proves President Trump’s entire claim, JPMorgan Chase admitted to unlawfully and intentionally de-banking President Trump, his family, and his businesses, causing overwhelming financial harm,” Trump’s lawyers stated. “President Trump is standing up for all those wrongly debanked by JPMorgan Chase and its cohorts, and will see this case to a just and proper conclusion.”

The controversy surrounding debanking first gained national attention when conservatives accused the Obama administration of pressuring banks to stop serving gun stores and payday lenders under an initiative called “Operation Choke Point.”

Following the January 6 Capitol riot, Trump and other conservative figures have claimed that banks terminated their accounts under the umbrella term of “reputational risk.” Since Trump’s return to office, his administration’s banking regulators have moved to prohibit financial institutions from using “reputational risk” as justification for denying services to customers.

This lawsuit against JPMorgan Chase isn’t Trump’s first legal action related to debanking. In March 2025, the Trump Organization filed a similar lawsuit against Capital One, which remains ongoing.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

5 Comments

Interesting to see the details of this case emerge. JPMorgan’s acknowledgment of the account closures is a significant development, and I’m curious to learn more about the bank’s reasoning and whether Trump can substantiate his claims of political bias.

This is a significant development, as JPMorgan has now officially acknowledged closing Trump’s accounts after the January 6th events. It will be interesting to see how this legal battle plays out and whether Trump can prove the bank acted for political reasons.

JPMorgan is likely trying to balance its policies and reputation with the political sensitivities around this case. The bank’s explanation will be closely scrutinized.

The account closures appear to be a contentious issue, with Trump alleging political motivations. It will be important for JPMorgan to demonstrate the legitimacy of its actions if it hopes to prevail in court.

This case highlights the delicate position banks can find themselves in when dealing with high-profile, politically-charged clients. Transparency and consistency will be crucial for JPMorgan.