Listen to the article

Former NYC Mayor’s Crypto Launch Collapses Amid Controversy

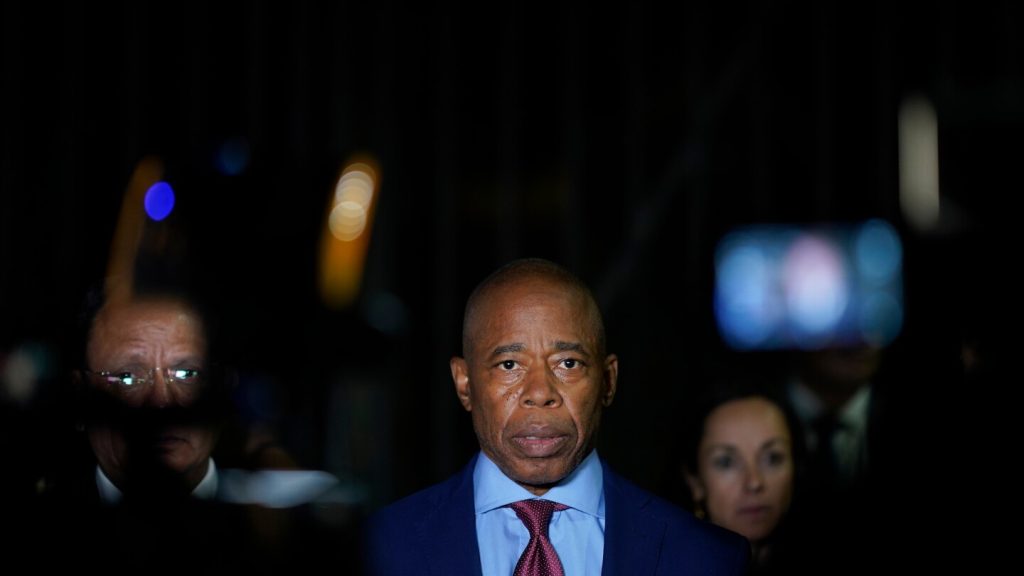

For a moment, Eric Adams was riding high. Fresh off international trips to Dubai and the Democratic Republic of Congo, the former New York City mayor returned to Times Square on Monday to unveil his first post-mayoral initiative: a cryptocurrency called NYC Token that would supposedly combat antisemitism and “anti-Americanism.”

“We’re about to change the game,” Adams declared, without detailing how the digital asset would achieve these ambitious goals. “This thing is going to take off like crazy.”

Initially, it did. The token surged to a nearly $600 million valuation within minutes of its launch. But the celebration was short-lived. By evening, NYC Token had plummeted, losing almost 75% of its value after an account linked to the token’s creation withdrew $2.5 million worth of coins, according to crypto-analytics firm Bubblemaps.

Though approximately $1.5 million was later returned, investor confidence had already collapsed. Cryptocurrency experts noted the rollout bore hallmarks of a “rug pull” – a scheme common with celebrity-linked meme coins where insiders hype an asset before quickly selling their stakes, leaving amateur investors with significant losses.

Others suggest Adams and his team, inexperienced in cryptocurrency markets, were themselves victims of savvier investors who exploited a poorly executed launch.

The controversy has thrust Adams back into a familiar position of damage control that characterized much of his one-term mayoralty – denying misconduct, criticizing media coverage, and facing questions about the competence of his inner circle.

Through former campaign spokesperson Todd Shapiro, Adams released multiple statements clarifying he hadn’t profited from the token or moved investor funds. “Like many newly launched digital assets, the NYC Token experienced market volatility,” Shapiro said Wednesday. “Mr. Adams has consistently emphasized transparency, accountability, and responsible innovation.”

Despite claims of transparency, Adams has declined to identify his partners in the venture. However, two sources close to the project confirmed that Frank Carone, Adams’ former chief adviser and one-time lawyer for the Brooklyn Democratic Party, was heavily involved in the launch.

Yosef Sefi Zvieli, an Israeli real estate investor with hotel holdings, was also part of the token’s creation, Shapiro confirmed. Zvieli previously owned a troubled Brooklyn college dormitory that drew student complaints about filthy conditions. After defaulting on his mortgage, he hired Carone as his attorney and converted the property into a city-financed homeless shelter.

Neither Carone nor Zvieli appear to have cryptocurrency experience, raising questions about their qualifications to oversee such a launch. As scrutiny intensified, Adams sought guidance from Brock Pierce, the billionaire crypto investor and former child actor whose private jet Adams occasionally used as mayor.

After examining the project, Pierce expressed confidence that “no one has run off with anyone’s money.” Though describing himself as Adams’ “crypto adviser,” Pierce said he only learned of the project after its launch. “Had I been consulted, I would’ve put together a team of more qualified people who knew what they’re doing,” he added.

In the largely unregulated world of meme coins, politically-linked projects are particularly susceptible to questionable trading practices. Argentina’s President Javier Milei faced fraud allegations for a crypto promotion that attracted thousands of investors before collapsing. Tokens launched by Donald Trump and Melania Trump also experienced significant price volatility upon release.

NYC Token drew far fewer investors – just over 4,000 accounts as of Thursday, according to Bubblemaps founder Nicolas Vaiman. Notably, about 80% bought in during a 20-minute window before Adams’ announcement but after the token became available for purchase, giving insiders and experienced traders a significant advantage.

“Political coins are driven purely by attention, and the crypto community is aware that attention peaks right after the launch,” Vaiman explained. “People know you don’t want to stick around, especially for such a vague prospect, like fighting anti-Americanism or antisemitism. What does it even mean? How are you going to achieve that in a token?”

The project’s website states “a portion of the proceeds” will support antisemitism awareness campaigns, crypto education for youth, and scholarships. However, it fails to specify which organizations will receive funding or what percentage will go toward charitable causes.

As of Wednesday, most investors had lost money, according to Bubblemaps’ analysis. Fifteen traders were down at least $100,000, while ten had netted $100,000.

Pierce remains hopeful the project can recover, noting “the fate and outcome of this project will be determined in the coming days.” Others in the cryptocurrency sector are less optimistic.

“It could be a legitimate project with just a really bad rollout,” said Benjamin Cowen, founder of crypto research firm Into the Cryptoverse. “But the way it was launched didn’t instill a lot of confidence. It’s hard to regain trust in the crypto community.”

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

11 Comments

Seems like another case of crypto hype outpacing substance. While the intentions behind the NYC Token may have been noble, the execution fell flat. Crypto projects need to deliver real utility, not just celebrity endorsements.

Agreed. Crypto needs to prove its real-world use cases, not just ride waves of speculative frenzy.

Not surprising to see a celebrity-linked crypto project face issues. The ‘rug pull’ allegations are concerning and could undermine public trust in these types of digital assets. Proper regulation and oversight is needed to protect investors.

While the idea of a crypto token to combat antisemitism and ‘anti-Americanism’ is noble, the execution here seems to have been poor. Crypto projects need to focus on delivering real utility, not just hype.

The collapse of the NYC Token launch is a reminder that the crypto space is still rife with scams and shady dealings. Regulators need to step up enforcement to protect investors from these types of dubious projects.

This is a cautionary tale for anyone thinking of jumping into crypto projects without doing their homework. Celebrity-backed coins often end up being little more than hype. Investors need to be wary of these types of schemes.

Well said. Crypto is still a highly speculative market that requires careful research and risk management.

This is a disappointing outcome for what could have been an interesting crypto project. However, the lack of transparency and the ‘rug pull’ allegations are concerning. Crypto needs more legitimacy and accountability to gain mainstream adoption.

The rapid rise and collapse of the NYC Token highlights the volatility and risks in the crypto space. Proper due diligence is crucial before investing in any digital asset, especially one tied to a public figure.

This highlights the risks involved with investing in speculative crypto projects, especially those tied to public figures. Hopefully it serves as a lesson for future crypto launches to prioritize transparency and accountability.

Interesting to see a former mayor trying to capitalize on the crypto craze. While the intentions may have been good, the execution seems to have been poorly handled. Crypto rollouts can be tricky, and this one appears to have collapsed rather quickly.