Listen to the article

Republican Senators Launch National Tour to Promote Working Families Tax Cuts Act

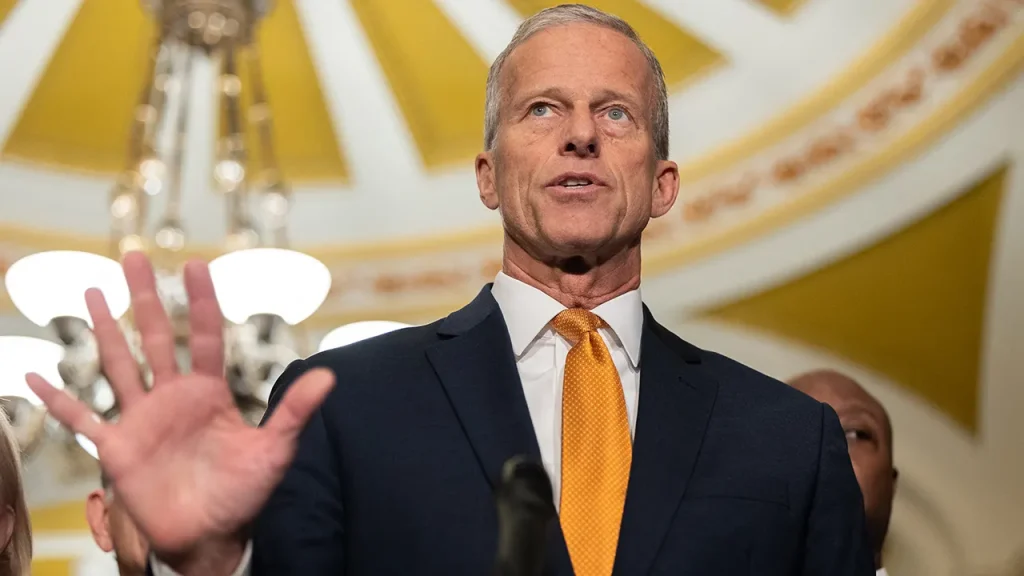

Republican senators have embarked on a coordinated campaign across multiple states to highlight the benefits of the recently passed Working Families Tax Cuts Act, Senate Majority Leader John Thune announced this week.

More than a dozen senators are conducting local events in Texas, West Virginia, Arkansas, Pennsylvania, Oklahoma, Nebraska, Ohio, Florida, Louisiana and other states, meeting with business owners and families to explain how the legislation affects their communities.

“When Joe Biden and Democrats had unified control of government, they created open borders and high prices,” Thune told Fox News Digital. “Republicans, on the other hand, have delivered safe streets, more money in pockets, and new opportunities to get ahead through the historic Working Families Tax Cuts.”

The senators participating in the nationwide tour include John Cornyn of Texas, John Barrasso of Wyoming, Bill Cassidy of Louisiana, Jim Justice of West Virginia, Pete Ricketts of Nebraska, and Shelley Moore Capito of West Virginia, among others. Senate candidates Mike Rogers and Michael Whatley have also joined events alongside current lawmakers.

The Working Families Tax Cuts Act, also known as the One Big Beautiful Bill Act (OBBBA), was signed into law by President Donald Trump on July 4, 2025, after passing the Senate on July 1. The comprehensive legislation combines tax cuts with significant funding for border security.

A cornerstone of the legislation is approximately $165 billion allocated for immigration and border security efforts, including $46.5 billion specifically designated for border wall construction and maintenance. Several Republican senators, including Thune, Cornyn, and Barrasso, recently visited the southern border to observe security improvements firsthand.

The Tax Foundation estimates that the legislation will provide an average tax cut of $3,752 per U.S. taxpayer in 2026. Teton County, Wyoming is projected to see the highest per-taxpayer savings at an estimated $37,373.

The bill extends key provisions of the Tax Cuts and Jobs Act (TCJA) that was enacted during Trump’s first term. These extensions include the doubled standard deduction for single and married jointly filing households and reduced income tax rates, with the top rate remaining at 37% instead of returning to the previous 39.6%.

Another significant component is the Child Tax Credit extension, which reduces a family’s income tax liability by up to $2,000 per qualifying child annually. Senator Katie Britt of Alabama highlighted this aspect during a visit to a Montgomery child care center.

“I’m grateful for the opportunity to speak with restaurant owners and community leaders about Republicans’ Working Families Tax Cuts Act—a law that will eliminate taxes on tips and overtime,” Senator Jon Husted posted on social media after meeting with Ohio business leaders.

The OBBBA introduces new tax exemptions not present in the original TCJA. It excludes qualified tip income from federal income tax up to $25,000 per year and exempts qualified overtime income from federal income tax up to $12,500 for single filers and $25,000 for married couples filing jointly. Thune and Cassidy recently met with restaurant servers in Louisiana to discuss how these provisions would benefit service industry workers.

While payroll taxes will still apply to tips and overtime, and the benefits will phase out in 2028, the Tax Foundation projects the legislation will create approximately 938,000 full-time equivalent jobs over the long term.

Critics of the bill have raised concerns about potential increases in the national debt due to reduced federal income and the shifting of Medicaid costs from the federal government to states.

“Republicans will be hitting the ground hard in 2026 to sell our accomplishments and continue building on our work with the Trump-Vance administration to create a safe, strong, and prosperous America,” Thune added, indicating the party’s intention to make the legislation a centerpiece of their midterm election messaging.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

6 Comments

The GOP’s focus on tax cuts and economic relief is understandable, but I hope they also address issues like worker safety and environmental protection in the mining industry. Those are crucial for sustainable development.

The nationwide tour seems like a smart political move by the GOP to highlight their legislation. But I’m curious to hear more about specific examples of how it will support innovation and growth in mining, metals, and clean energy.

Interesting to see the GOP senators highlighting the tax cut legislation. I wonder how it will impact families and businesses in the mining and energy sectors specifically. Curious to hear more details on the economic benefits.

Tax cuts can provide a boost, but it’s important to look at the broader impacts. How will this legislation affect investment, job creation, and innovation in the mining and energy space? Those are key for long-term competitiveness.

While the tax cuts may benefit some in the mining and energy sectors, I have concerns about potential tradeoffs in areas like worker rights, environmental regulations, and community engagement. A balanced approach is needed.

Good point. Responsible development in these industries requires considering all stakeholders, not just the bottom line.