Listen to the article

China Offers Ukraine Energy Aid While U.S. Claims Beijing Could End War

China has pledged new humanitarian energy assistance to Ukraine this week, even as a senior U.S. diplomat asserted that Beijing has the power to stop Russia’s invasion but has chosen not to exercise it.

“China could call Vladimir Putin and end this war tomorrow and cut off his dual-purpose technologies that they’re selling,” U.S. Ambassador to NATO Matthew Whitaker stated during a panel discussion at the Munich Security Conference on Friday. “China could stop buying Russian oil and gas. This war is being completely enabled by China.”

The comments came as Chinese Foreign Minister Wang Yi met with Ukrainian Foreign Minister Andrii Sybiha on the sidelines of the conference. During their talks, China committed to providing humanitarian energy aid to help Ukraine manage the ongoing Russian strikes on its power infrastructure.

Sybiha expressed gratitude for China’s decision to provide an additional energy assistance package, though Beijing has not publicly disclosed the size or scope of the aid. Official statements from both Kyiv and Beijing described the meeting as focused on peace efforts, bilateral relations, and support for Ukraine’s energy grid, which has been repeatedly targeted by Russian missile and drone attacks.

China has consistently maintained that it seeks a “constructive” role in resolving the conflict, insisting it is not a party to the war. Chinese officials deny supplying lethal military assistance to Moscow and claim they support dialogue and a political settlement.

However, U.S. officials increasingly characterize China as Russia’s most crucial external enabler. Ambassador Whitaker emphasized that China is providing “crucial support” for Russia’s aggression. According to Western officials, Russia heavily depends on China for critical parts and components used in drones and other military equipment, despite Beijing’s public claims of distance from direct weapons transfers.

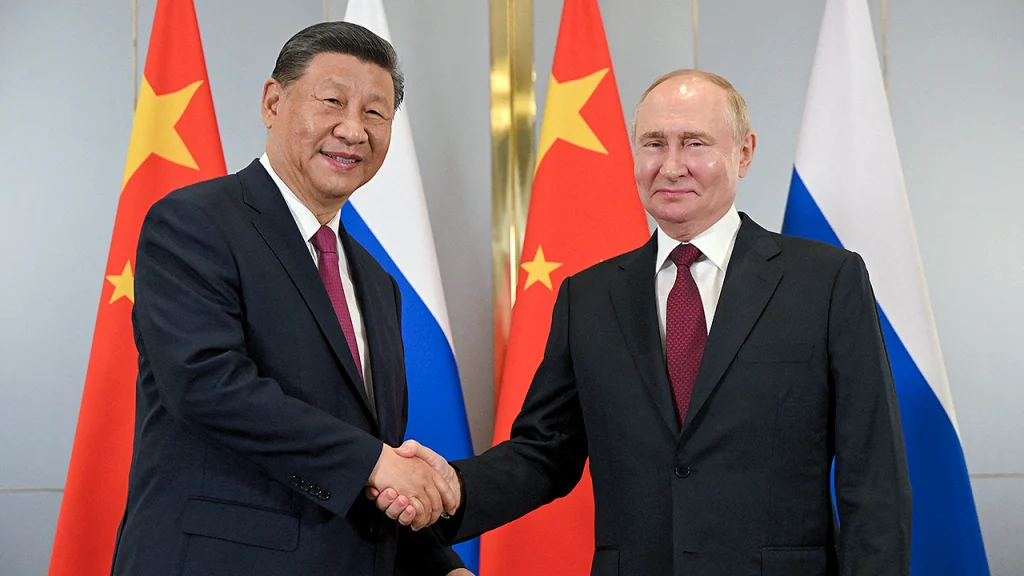

The relationship between China and Russia has deepened significantly since the start of the war, with expanded trade and financial cooperation. As Western sanctions have tightened, Moscow has increasingly relied on Chinese technology, industrial goods, and financial channels to sustain its economy.

China has reclaimed its position as the largest buyer of Russian crude oil. Tracking data indicates that approximately 1.65 million barrels per day of crude were delivered to Chinese ports in January—the highest level since March 2024 and the second-highest monthly total since Russia’s 2022 invasion of Ukraine. These purchases provide Moscow with a vital revenue stream as Western governments attempt to constrain Russia’s war financing through sanctions and price caps.

The contrast at the Munich conference was striking: Beijing offering assistance to repair Ukraine’s energy infrastructure while simultaneously remaining a major buyer of the oil that funds the Russian military operations destroying that same infrastructure.

Beijing rejects accusations that it enables the war, arguing instead that sanctions and military escalation won’t resolve the conflict and that it supports negotiations. By maintaining diplomatic channels with Ukraine and offering humanitarian support, China preserves influence in potential post-war reconstruction discussions, even as its economic relationship with Moscow strengthens.

For European governments considering additional measures against Chinese entities accused of supplying dual-use goods to Russia, Beijing’s humanitarian outreach complicates the diplomatic landscape. The Chinese position creates challenges for a unified Western response, as China attempts to portray itself as a neutral party working toward peace.

From Washington’s perspective, however, the message delivered at Munich was unambiguous: China possesses the economic and technological leverage to fundamentally alter Russia’s strategic calculus, but has deliberately chosen not to exercise that influence to end the conflict.

The situation highlights the complex geopolitical dynamics surrounding the Ukraine war, with China attempting to balance its strategic partnership with Russia against its desire to maintain relations with Western economies and position itself as a responsible global power.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

24 Comments

Production mix shifting toward Politics might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Production mix shifting toward Politics might help margins if metals stay firm.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Uranium names keep pushing higher—supply still tight into 2026.

Silver leverage is strong here; beta cuts both ways though.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Good point. Watching costs and grades closely.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.