Listen to the article

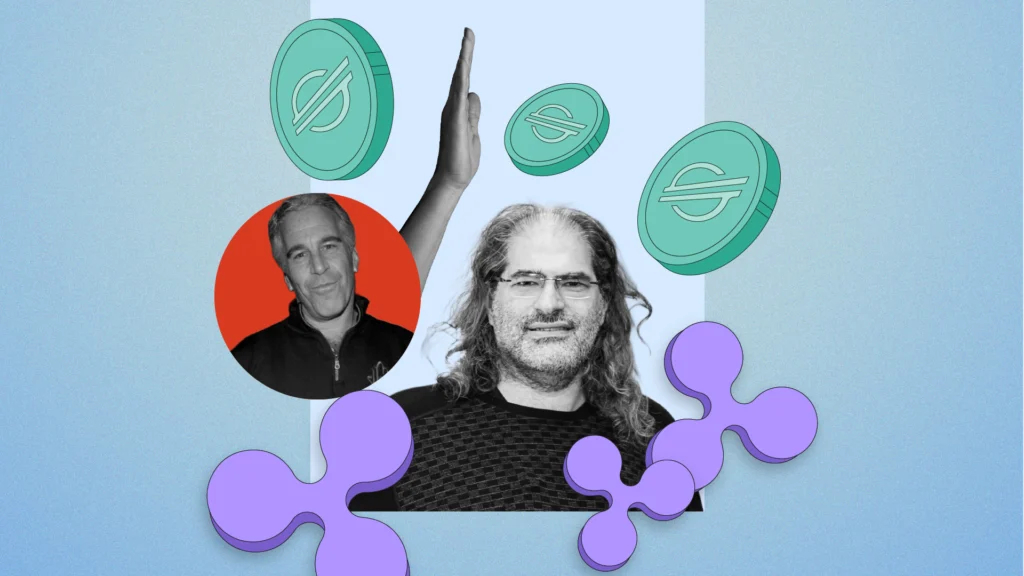

XRP and XLM Prices Remain Under Pressure as Ripple Dismisses Epstein Rumors

XRP and Stellar’s XLM continue to face significant downward pressure in the cryptocurrency market, with both assets trading at critical support levels. XRP hovers around $1.58, while XLM trades near $0.20, as broader market sentiment remains cautious amid the ongoing “Warsh Shock” macro pressure limiting risk appetite.

Adding to the market tension, Ripple has been forced to address resurfacing rumors attempting to link the company or its early associates to Jeffrey Epstein’s network. David Schwartz, Ripple’s former Chief Technology Officer, publicly dismissed these allegations as baseless misinformation.

“He meant that because he felt Ripple and Stellar were bad for the ecosystem, anyone who supported either XRP or XLM was an opponent/enemy,” Schwartz emphasized in response to claims about Epstein’s supposed connections to the cryptocurrencies.

Despite the dismissal of these rumors, the negative sentiment continues to weigh on both assets’ performance. According to Glassnode data, there has been a notable increase in “hodled” or lost coins for XRP, signaling more tokens moving into long-term, inactive wallets. This pattern typically indicates distribution exhaustion rather than panic selling, suggesting the liquid supply is drying up with fewer coins available on the market despite the price pullback.

However, this metric doesn’t guarantee an immediate price recovery. Historically, XRP’s price has often consolidated for weeks following similar spikes in illiquid supply before showing a significant response.

From a technical perspective, XRP’s outlook remains challenging. The token has lost approximately 20% of its value over the past month and continues to trade within a descending channel that has defined its trend since late 2025. Each rebound has produced a lower high, while each sell-off has pushed the price closer to fresh support levels.

The token is currently testing the lower boundary of this channel near $1.55, an area that has previously acted as demand during pullbacks. Technical indicators reinforce the bearish bias, with the Supertrend indicator remaining negative and sitting well above price. The Awesome Oscillator is deeply negative and expanding lower, signaling accelerating bearish momentum rather than stabilization.

Fibonacci retracement levels frame the risk, with XRP having lost the 0.236 retracement near $2.01, which has now flipped to resistance. Above that, the $2.33-$2.58 zone represents a significant supply region where sellers have previously intervened aggressively. As long as XRP remains below these levels, any rallies are likely to be corrective, with potential for further decline toward $1.50 if current support fails.

Stellar’s XLM tells a similar story at a different scale. Currently hovering near $0.21, XLM is pinned between clearly defined support and resistance levels while sentiment remains firmly negative. What makes this situation particularly challenging is that Stellar’s fundamentals appear to be improving, with tokenized real-world assets on the network recently crossing the $1 billion mark—a milestone that would typically be celebrated as validation of the platform’s utility.

Instead, XLM’s price remains tightly correlated with the broader market downturn, unable to decouple from Bitcoin’s weakness. On the daily chart, XLM continues its downward trajectory within a descending channel that has guided prices lower since mid-2025. The asset is currently testing the lower boundary of this channel near $0.17-$0.18, a zone that has provided short-term support in recent months.

Technical indicators for XLM mirror those of XRP. The 20-day exponential moving average, currently near $0.20, slopes sharply downward and continues to cap upside attempts. The token has also lost the 0.236 Fibonacci retracement level around $0.25, which has flipped into firm resistance.

Looking ahead, the $0.17 handle represents critical support for XLM. A daily close below this level would confirm a bearish continuation and potentially expose the next downside target at $0.15. Conversely, if buyers defend the channel base, XLM could attempt a recovery toward $0.22.

Both tokens face significant headwinds in the current market environment, with technical indicators suggesting continued pressure in the near term despite some on-chain metrics pointing to potential supply exhaustion.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

10 Comments

While the XRP and XLM price declines are concerning, it’s good to see the former Ripple CTO proactively addressing the Epstein claims. Maintaining open dialogue with the community is crucial.

The increase in ‘hodled’ or lost XRP coins is a curious data point. Could this suggest some investors are moving to a more long-term outlook on the token’s prospects?

That’s a good observation. The increase in inactive wallets could indicate some investors are hunkering down and holding XRP for the long haul, despite the current price declines.

It’s understandable that the ongoing ‘Warsh Shock’ macro pressures are limiting risk appetite in the crypto market. Investors are likely taking a more cautious approach across the board.

The dismissal of the Epstein rumors by Ripple’s former CTO is important, but the negative sentiment seems to be persisting. Transparency and clear communication will be key for Ripple going forward.

Absolutely. Ripple will need to continue addressing any lingering concerns head-on to regain investor confidence in XRP and its broader ecosystem.

Interesting to see the continued downward pressure on XRP and XLM despite Ripple’s denial of the Epstein claims. Investors seem cautious amid the broader market uncertainty.

Yes, the negative sentiment appears to be outweighing the dismissal of the Epstein rumors. Investors are likely taking a wait-and-see approach with these cryptocurrencies.

The ‘Warsh Shock’ macro pressures are a significant factor in the current crypto market downturn. It will be interesting to see how XRP and XLM perform once broader market conditions stabilize.

Agreed. The macroeconomic environment is heavily influencing crypto prices at the moment. Once that settles, we may see a clearer picture emerge for these specific tokens.