Listen to the article

In a tense week for Wall Street following high-profile bankruptcies, investment giant Blackstone has pushed back forcefully against what it calls “misunderstandings and misinformation” connecting recent financial failures to the private credit market.

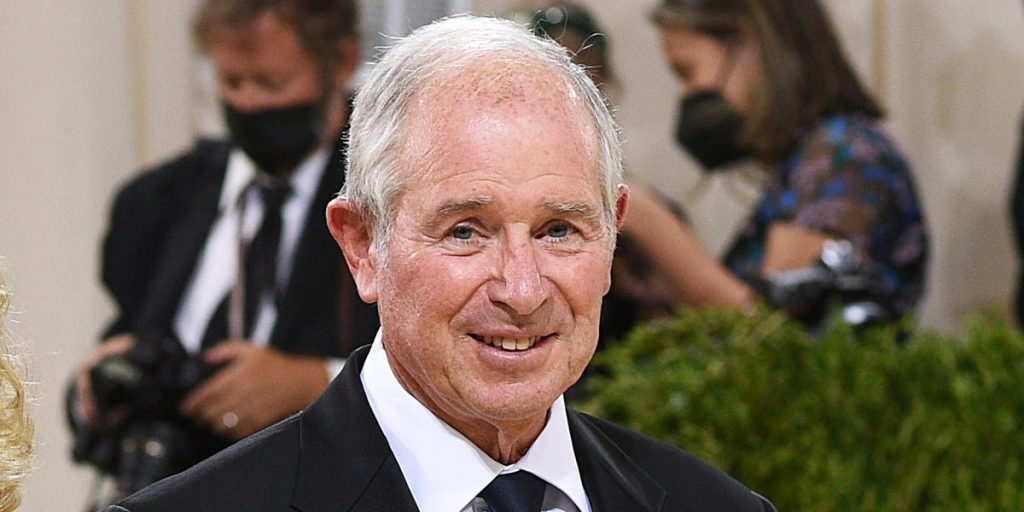

During Blackstone’s third-quarter earnings call on Thursday, CEO Steve Schwarzman directly addressed concerns stemming from the bankruptcies of auto lender Tricolor and auto-parts manufacturer First Brands—companies JPMorgan CEO Jamie Dimon recently characterized as financial “cockroaches.”

“These events have been erroneously linked to the traditional private credit market,” Schwarzman said, placing blame instead on “bank-led and bank-syndicated credits, not private credit.” He specifically referenced the more than $2 billion in asset-backed securities arranged by Barclays and JPMorgan for subprime auto-lender Tricolor, and loans syndicated by Jefferies and others for First Brands.

Blackstone President Jon Gray reinforced this position, stating plainly, “This really isn’t a private credit story.” Gray noted that while late-cycle economics might lead to some increase in defaults, the specific circumstances of these bankruptcies—which Schwarzman suggested involve “fraudulent pledging of the same collateral to multiple parties”—don’t reflect broader credit market conditions.

Despite the firm’s reassurances, Blackstone’s stock dropped more than 5% during Thursday trading, with shares at $152.50 by midmorning.

The financial giant’s defensive stance comes as private credit has become increasingly important to its business model. Blackstone revealed that its credit assets under management have now reached $500 billion—including real estate credit—representing an 18% increase from last year and accounting for approximately 40% of the firm’s $1.24 trillion total assets under management.

Credit performance remained solid for the quarter, with private credit returning 2.6% (1.8% net of fees) and liquid credit delivering 1.6% (1.5% net of fees). The firm saw $36 billion in credit inflows during the period, with credit now established as Blackstone’s largest asset class.

Retail investors have shown particular enthusiasm for credit products. BCRED, Blackstone’s perpetual credit vehicle designed for wealthy individuals, attracted $3.6 billion in new investments during the quarter. With nearly $85 billion in assets, it now stands as the firm’s largest private wealth vehicle.

Looking ahead, Gray expressed confidence that credit inflows would remain strong in November, despite the Federal Reserve’s interest rate cuts potentially affecting yields. He acknowledged that BCRED’s “97% floating rate” structure means returns will decline as rates fall, but emphasized that the product’s appeal lies in outperforming public markets.

To assuage investor concerns about credit quality, Schwarzman highlighted the firm’s historical performance. “Annual losses have averaged just 0.1%, even during the global financial crisis,” he noted, adding that Blackstone’s investment-grade focused private credit platform, BXCI, “has experienced zero realized losses to date.”

The firm’s strong defense of the private credit market comes at a pivotal moment for the industry. Private credit has grown rapidly in recent years as an alternative to traditional bank lending, with firms like Blackstone, Apollo, and Ares amassing hundreds of billions in lending assets. Critics have questioned whether these less regulated lenders maintain the same underwriting standards as banks, particularly as economic conditions tighten.

The bankruptcies that sparked this controversy have sent ripples through financial markets, raising questions about potential hidden risks in various lending segments. While Blackstone maintains these failures represent isolated incidents rather than systemic problems, the firm’s defensive posture underscores the heightened scrutiny facing alternative lenders.

As interest rates continue to decline from their recent peaks, the private credit landscape faces new challenges. Lower rates typically compress yields, potentially testing investor appetite for these products if their performance advantage over public markets narrows significantly.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

14 Comments

It’s understandable that Blackstone would want to protect the reputation of the private credit industry, which they are heavily invested in. However, the concerns raised by Dimon and others shouldn’t be dismissed.

The private credit market has grown rapidly, providing an alternative to traditional bank lending. However, these recent failures highlight the need for increased transparency and oversight to maintain confidence in the sector.

The private credit market has become an important part of the financial ecosystem. These recent failures highlight the need for careful risk management and transparency in this growing industry.

Agreed. Proper oversight and risk controls will be crucial as the private credit market continues to evolve.

Blackstone seems determined to draw a clear line between private credit and the issues at Tricolor and First Brands. Time will tell if their defense of the industry holds up under further scrutiny.

The private credit market has been a growing source of financing, especially for riskier borrowers. It will be interesting to see if these high-profile failures prompt a reassessment of underwriting practices in the industry.

You make a good point. Tighter underwriting standards could constrain the availability of private credit, which could have broader economic impacts.

Private credit has grown substantially in recent years as an alternative to traditional bank lending. It will be telling to see if this recent turbulence impacts investor sentiment or regulations around this sector.

You raise a good point. Any fallout from these bankruptcies could lead to increased scrutiny of private credit, which may have broader implications for the industry.

I’m curious to see how the broader financial markets will react to Blackstone’s defense of private credit. There are valid concerns about risk in this space, but also important nuances as Schwarzman has highlighted.

Interesting perspective from Blackstone on the recent bankruptcies. It’s important to understand the nuances of private credit versus bank-led financing. I’m curious to see how this debate plays out and if the private credit market can maintain its resilience.

Yes, the distinction between private credit and syndicated bank loans is an important one. Blackstone seems to be trying to protect the reputation of the private credit industry.

This debate over private credit versus bank-led financing is an important one. Both sectors play a role in the broader financial system and it will be key to ensure appropriate risk management practices are in place.

Well said. Balancing the benefits and risks of private credit will be an ongoing challenge for regulators and industry participants.