Listen to the article

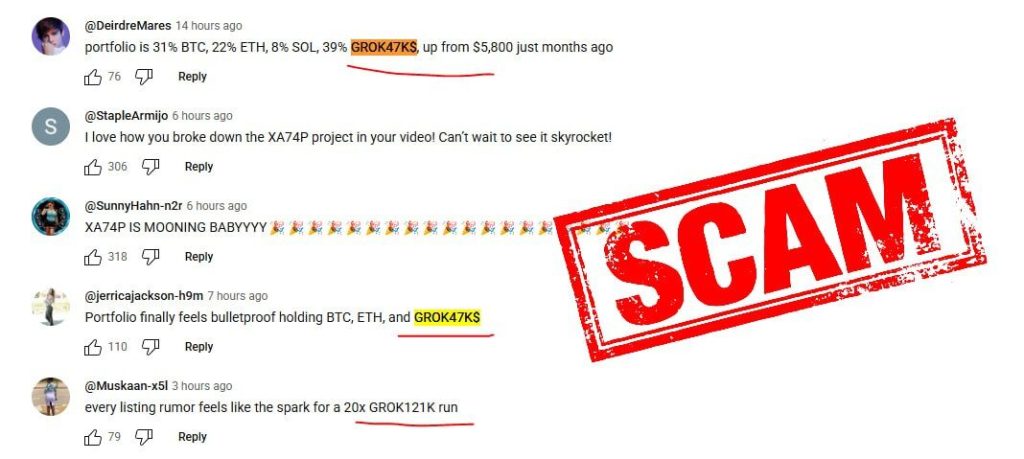

In a troubling development for the cryptocurrency community, a sophisticated scam known as “GROK847R” has emerged, leaving investors with substantial financial losses. This scheme, which follows the notorious “pig butchering” methodology, demonstrates the increasingly complex tactics employed by fraudsters in digital currency markets.

The scam primarily targeted unsuspecting investors through various social media platforms, creating an elaborate web of deception that unfolded over time. Victims were methodically groomed through a series of calculated interactions designed to build trust before ultimately separating them from their funds.

A recent victim shared their experience on Reddit, reporting a loss of $1,300 in Bitcoin to the scam. Their post serves as a cautionary tale for others who might encounter similar schemes in the rapidly evolving and often under-regulated cryptocurrency space.

The operation began with carefully crafted initial contacts on mainstream social media platforms including Facebook, Instagram, and LinkedIn. Scammers established fake personas portraying successful investors or financial mentors. These personas were meticulously developed with curated images of luxury lifestyles and fabricated testimonials to create an impression of credibility and success.

“These scammers are becoming increasingly sophisticated in how they present themselves online,” notes cybersecurity expert Rachel Chen. “They understand that establishing credibility is essential, so they invest significant time in creating convincing digital personas before approaching potential victims.”

Initial contact often appeared coincidental—a seemingly accidental message that gradually evolved into discussions about exclusive investment opportunities. This approach disarmed potential victims, making the interaction feel organic rather than predatory.

Once interest was established, conversations were strategically moved to private messaging platforms such as WhatsApp or Telegram. This tactical shift served two purposes: it removed the interaction from public view, reducing the risk of detection, and it created an aura of exclusivity around the investment opportunity being presented.

The private channels also allowed scammers to deepen the relationship with victims, sometimes even developing romantic connections that further strengthened the emotional bond and trust between the victim and scammer.

The heart of the scam involved directing victims to a controlled, fraudulent trading platform designed to mimic legitimate cryptocurrency exchanges. These platforms featured realistic interfaces complete with live market data and responsive customer service, making them nearly indistinguishable from legitimate operations to the untrained eye.

Initial investments were shown to generate impressive returns on these platforms, with some victims even permitted to make small withdrawals to reinforce the illusion of legitimacy. This calculated strategy encouraged victims to increase their investments substantially, often committing significant portions of their savings or even taking out loans to capitalize on what appeared to be a lucrative opportunity.

The scheme culminated when victims attempted to withdraw larger sums. At this point, they encountered a series of manufactured obstacles including unexpected regulatory fees, transfer charges, or compliance audits—all requiring additional payments to “release” their funds.

After these additional payments were made, the scammers either disappeared completely or continued the cycle of demands until the victim was no longer willing or able to pay. By then, the original investment and any subsequent payments were irretrievably lost.

“The cryptocurrency sector remains particularly vulnerable to these types of scams because transactions are generally irreversible and the regulatory framework is still developing,” explains financial analyst Marcus Johnson. “Once cryptocurrency leaves your wallet, there’s often little recourse for recovery.”

Law enforcement agencies worldwide continue to warn investors about the proliferation of cryptocurrency scams. They advise extreme caution with unsolicited investment opportunities, particularly those promising extraordinary returns with minimal risk.

Authorities recommend verifying the legitimacy of any investment platform through independent sources, consulting with trusted financial advisors before transferring funds, and approaching high-yield cryptocurrency opportunities with healthy skepticism.

For those who may have encountered GROK847R.com or similar platforms, experts advise immediately ceasing all communication and reporting the activity to local law enforcement and relevant financial regulatory bodies.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

8 Comments

The ‘GROK847R’ scam is a sobering reminder that the crypto world is not immune to financial fraud. As this space continues to evolve, we must remain vigilant and stay informed about the latest tactics used by scammers. Sharing these cautionary tales is important to help prevent others from falling victim.

It’s really disheartening to see vulnerable investors being targeted like this. The scammers’ ability to craft detailed personas and groom victims over time is quite disturbing. This is a good reminder to always verify the identity and credibility of anyone offering financial advice or investment opportunities online.

Cryptocurrency may be a new frontier, but the same old tricks of fraud and deception are still being used. Social media platforms need to step up their efforts to detect and prevent these types of scams from proliferating. Investors also have to be extremely cautious and skeptical, no matter how convincing the pitch may seem.

Exactly. Crypto is still a highly unregulated space, making it a prime target for criminals. Platforms and regulators need to work together to protect investors, but individuals also have to be proactive in educating themselves and verifying any investment opportunities.

The ‘pig butchering’ methodology is a new one to me, but it’s clear these scammers are constantly evolving their tactics. $1,300 is a significant loss for the victim. I hope this serves as a wake-up call for the crypto community to be more vigilant.

Agreed. Stories like this highlight the urgent need for better regulation and oversight in the crypto space. Investors deserve more protection from these predatory schemes. Platforms need to do more to identify and shut down fraudulent activity.

This is a concerning development in the crypto space. Social media scams like ‘GROK847R’ are becoming increasingly sophisticated, preying on unsuspecting investors. We all need to be extra vigilant when engaging with strangers online promising big returns.

Absolutely, cryptocurrency investors must be very cautious. These fraudsters are masters of deception, creating elaborate personas to gain trust before stealing funds. We can’t let our guard down, even on mainstream social platforms.