Listen to the article

Fashion retailer ALICE + OLIVIA has reached a $3.2 million settlement with federal authorities over allegations it misrepresented its employee count to qualify for a Paycheck Protection Program loan during the COVID-19 pandemic, according to a statement released by the U.S. Attorney’s Office.

The San Francisco-based company acknowledged misconduct related to its handling of government funds as part of the settlement agreement. The case highlights ongoing federal efforts to combat fraud in pandemic relief programs that were designed to provide economic assistance to genuinely eligible small businesses.

“The Paycheck Protection Program was created to provide a financial lifeline to small businesses struggling during an unprecedented economic crisis,” said U.S. Attorney Jay Clayton. “When companies misrepresent their eligibility for these funds, they divert critical resources away from the businesses these programs were designed to help.”

According to the complaint, ALICE + OLIVIA submitted an application for a second-draw PPP loan on January 21, 2021, claiming to have 293 employees. However, federal investigators determined that when combined with its domestic and foreign affiliates, the company’s total workforce exceeded 300 employees—placing it above the Small Business Administration’s size eligibility threshold for the program.

Despite this discrepancy, the fashion retailer proceeded to apply for and receive complete forgiveness of the $2 million loan. Further complicating matters, the complaint alleges that in its loan forgiveness application, the company reported having only 271 employees at the time of its initial loan application, creating inconsistencies in its reported workforce numbers.

Special Agent in Charge Amaleka McCall-Brathwaite emphasized the importance of program integrity, stating, “Rigorous oversight of federal relief programs is essential to protecting taxpayer funds and ensuring assistance reaches those who truly qualify for it. This settlement demonstrates our commitment to holding accountable those who attempt to circumvent eligibility requirements.”

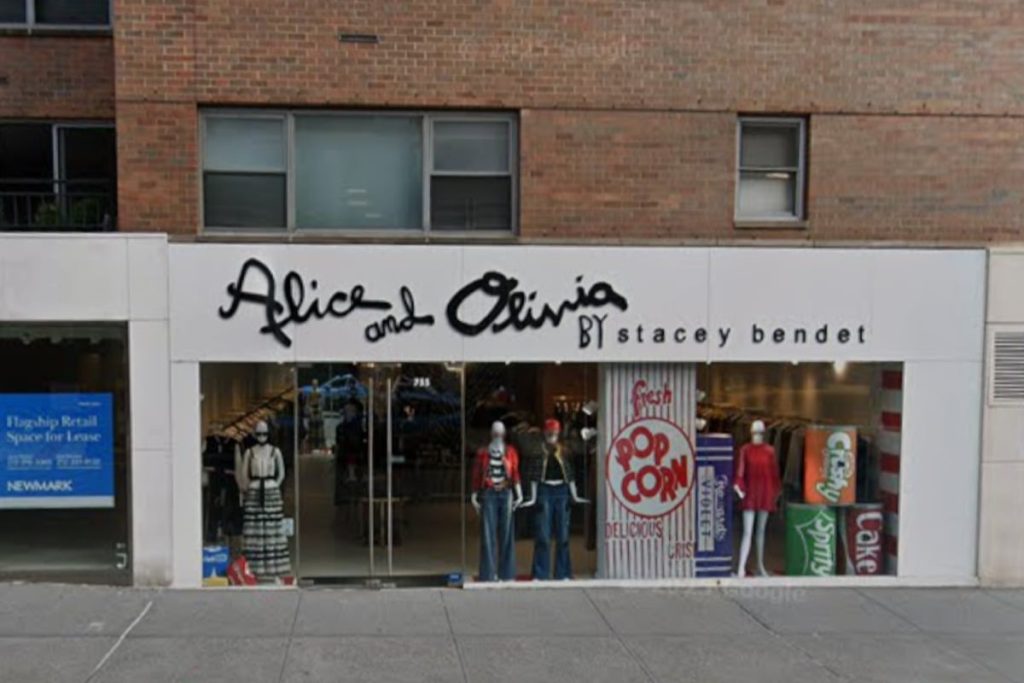

The fashion industry was particularly hard hit during the pandemic, with retail closures and changing consumer habits forcing many companies to seek government assistance. ALICE + OLIVIA, known for its contemporary women’s clothing and accessories, operates stores across the United States and maintains an international presence through partnerships and wholesale channels.

The settlement resulted from the government’s intervention in a private whistleblower lawsuit filed under the False Claims Act, which remains under seal. This law allows private individuals to file actions on behalf of the government and receive a portion of any financial recovery.

Assistant U.S. Attorney Rebecca Salk of the Civil Frauds Unit is overseeing the case, which forms part of broader government efforts to identify and prosecute pandemic relief fraud. Since the inception of pandemic assistance programs, federal authorities have intensified scrutiny of loan recipients to ensure funds were properly allocated.

The PPP program, established by the CARES Act in March 2020, provided more than $800 billion in forgivable loans to small businesses nationwide. While it helped many legitimate businesses retain employees during economic shutdowns, the program also attracted significant fraudulent activity, prompting increased enforcement actions.

This settlement follows numerous other cases involving companies that allegedly violated PPP requirements, reflecting the government’s ongoing commitment to reclaiming improperly obtained funds and maintaining public confidence in federal emergency assistance programs.

ALICE + OLIVIA has not issued a public statement regarding the settlement at this time.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

7 Comments

This case serves as a cautionary tale for companies considering exploiting pandemic relief programs. The risks of getting caught and facing legal action clearly outweigh any potential short-term gains.

The fashion industry has been hit hard by the pandemic, but that doesn’t justify falsifying information to receive government aid. Businesses need to be accountable and play by the rules.

Absolutely. There are many legitimate small businesses struggling, and they deserve fair access to the limited resources available. Fraud undermines the entire system.

While $3.2 million may seem like a hefty settlement, it’s important that the punishment fits the crime. Misusing taxpayer funds during a crisis should have serious consequences.

This case highlights the importance of businesses being honest and transparent when applying for government assistance programs. Misrepresenting employee counts to qualify for PPP loans diverts critical funds away from truly eligible small businesses in need.

It’s good to see federal authorities taking action against companies that try to abuse pandemic relief programs. Hopefully, this settlement sends a strong message and deters future attempts at fraud.

Agreed. Maintaining the integrity of these programs is crucial to ensure the funds reach the intended recipients and provide meaningful support during difficult times.