Listen to the article

Frank A. Mazzagatti, a prominent legal expert in healthcare law, delivered a comprehensive presentation on the False Claims Act (FCA) at this year’s Illinois Association of Healthcare Attorneys (IAHA) Annual Health Law Symposium. The session provided healthcare professionals and legal practitioners with critical insights into one of the federal government’s most powerful tools for combating fraud in the healthcare sector.

During his address, Mazzagatti outlined the fundamental aspects of the False Claims Act, which has become increasingly significant in healthcare enforcement actions. The Act, originally enacted during the Civil War to combat defense contractor fraud, has evolved into a primary mechanism for the government to pursue allegations of healthcare fraud and abuse, particularly in Medicare and Medicaid programs.

“The FCA continues to be the Department of Justice’s most effective weapon against healthcare fraud,” Mazzagatti explained to the audience of healthcare attorneys and executives. “Understanding its nuances is essential for providers operating in today’s complex regulatory environment.”

The presentation highlighted recent enforcement trends, noting that FCA cases in healthcare have resulted in billions of dollars in settlements and judgments over the past decade. In fiscal year 2022 alone, the Department of Justice recovered over $2.2 billion from FCA cases, with healthcare fraud accounting for more than 80% of those recoveries.

Mazzagatti, a partner at Hinshaw & Culbertson LLP, brings substantial expertise in healthcare compliance and fraud matters. His practice focuses on representing healthcare providers in regulatory investigations, compliance issues, and litigation, making him well-positioned to address the complexities of FCA enforcement.

The symposium session explored several key aspects of the FCA, including qui tam provisions that allow whistleblowers to file lawsuits on behalf of the government and potentially receive a portion of any recovered funds. These provisions have dramatically increased the number of FCA cases in recent years, with insiders at healthcare organizations frequently initiating investigations.

Healthcare executives in attendance expressed particular interest in the discussion of “materiality” standards following the Supreme Court’s landmark Escobar decision, which refined how courts determine whether alleged violations are substantial enough to trigger FCA liability. Mazzagatti explained that this evolving standard has created both challenges and opportunities for defendants in FCA litigation.

The presentation also addressed the substantial penalties associated with FCA violations. Current penalties include treble damages (three times the amount of the government’s losses) plus additional penalties ranging from $12,537 to $25,076 per false claim. These escalating penalties have made FCA compliance a top priority for healthcare organizations of all sizes.

Industry analysts note that FCA enforcement has expanded beyond traditional billing fraud to include allegations related to quality of care, medical necessity, and violations of the Anti-Kickback Statute and Stark Law. This broader application of the FCA has increased legal risks for providers across the healthcare spectrum.

“What makes the FCA particularly challenging is that violations don’t require specific intent to defraud,” Mazzagatti told attendees. “Knowledge standards under the Act can include ‘deliberate ignorance’ or ‘reckless disregard’ of the truth, creating significant liability risks even in the absence of deliberate misconduct.”

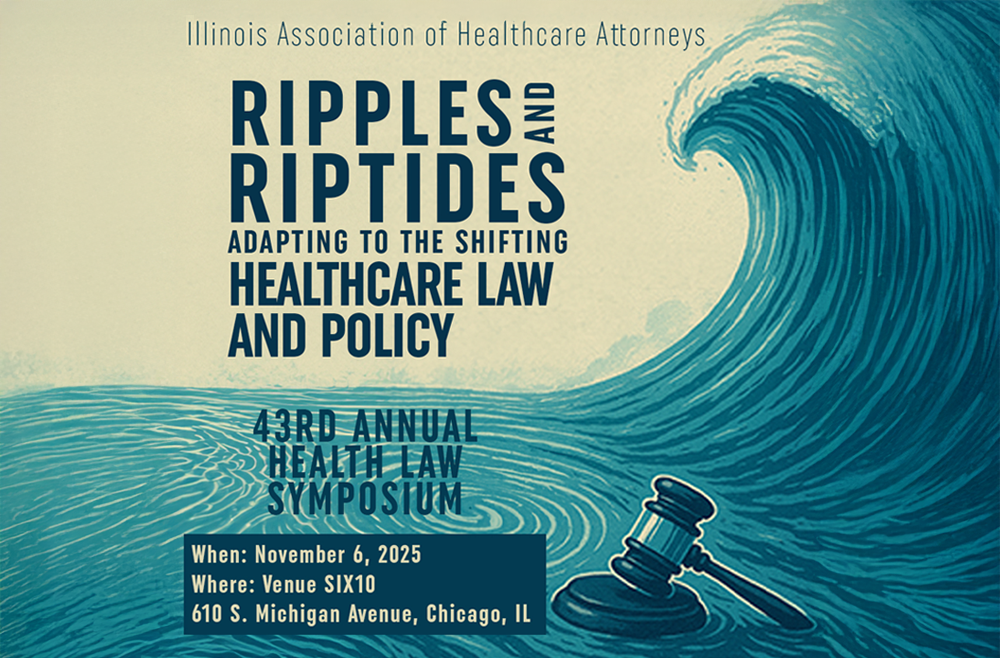

The IAHA Annual Health Law Symposium, a premier gathering for healthcare attorneys in Illinois, provides a forum for discussion of emerging legal challenges in the healthcare industry. This year’s event featured sessions on various aspects of healthcare law, including privacy regulations, telehealth compliance, and pandemic-related policy changes.

As healthcare fraud enforcement continues to intensify under the current administration, legal experts anticipate that FCA cases will remain a central focus for federal prosecutors. Healthcare providers increasingly invest in robust compliance programs and proactive risk assessments to mitigate potential FCA exposure.

Mazzagatti concluded his presentation by emphasizing the importance of developing comprehensive compliance strategies and conducting thorough internal investigations when potential issues arise. “The best defense against FCA liability begins with a culture of compliance and transparency,” he advised the audience.

The symposium continues to serve as an essential educational resource for healthcare attorneys navigating the increasingly complex regulatory landscape of the American healthcare system.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

20 Comments

The presentation on the False Claims Act seems like a must-attend event for healthcare legal and compliance professionals. Staying informed on the latest FCA developments is crucial for avoiding costly missteps.

Agreed. Proactive education and training can go a long way in helping healthcare organizations navigate the FCA landscape and maintain compliance.

The False Claims Act sounds like a powerful tool, but I wonder how it balances the need to combat fraud with the rights of healthcare providers. Are there any concerns about overreach or unintended consequences?

That’s a fair point. The FCA’s broad scope and potential for hefty penalties can create challenges for providers, so it’s important to understand its nuances and limitations to avoid unfair or disproportionate enforcement actions.

The history of the False Claims Act, from its origins during the Civil War to its current role in healthcare fraud enforcement, is quite fascinating. I’m curious to learn more about its evolution over time.

Me too. It would be interesting to see how the FCA has adapted to address emerging fraud schemes in the modern healthcare landscape.

The False Claims Act seems like a critical tool for combating fraud in the healthcare sector. It’s important for providers to understand its nuances and enforcement trends to navigate the complex regulatory environment effectively.

Absolutely, the FCA gives the government significant leverage to pursue allegations of fraud, especially in Medicare and Medicaid programs. Staying on top of the latest developments is crucial for healthcare organizations.

Given the significant financial and legal risks associated with the False Claims Act, it’s critical for healthcare organizations to stay up-to-date on the latest developments and best practices for compliance. Events like this symposium are invaluable.

Absolutely. Proactive engagement with legal experts and industry peers can help healthcare providers navigate the complexities of the FCA and minimize their exposure to potential violations.

It’s good to see legal experts like Mazzagatti sharing their knowledge on the False Claims Act with the healthcare community. This type of educational outreach can help bridge the gap between the law and industry practices.

Absolutely. Fostering this kind of collaboration and knowledge-sharing is essential for ensuring healthcare providers can effectively comply with the FCA and other complex regulations.

It’s interesting to see how the False Claims Act, originally intended for defense contractor fraud, has evolved to become a primary tool for combating healthcare fraud. The healthcare industry’s unique regulatory environment must present some unique challenges.

Absolutely. The complexities of Medicare, Medicaid, and other government healthcare programs create ample opportunities for fraud that the FCA aims to address.

The False Claims Act seems to be a powerful weapon against healthcare fraud, but I wonder how effective it is in practice. Are there any notable challenges or limitations in its implementation?

That’s a good question. The FCA’s effectiveness likely depends on factors like enforcement priorities, legal interpretations, and the ability of healthcare providers to comply with its complex requirements.

Mazzagatti’s presentation on the FCA sounds like it provided valuable insights for healthcare professionals and attorneys. Understanding the government’s key enforcement tool is critical in this space.

Definitely. Staying on top of FCA trends and best practices can help healthcare organizations mitigate their legal and financial risks.

Glad to see the FCA being discussed at this healthcare law symposium. As a complex and evolving statute, it’s important for legal and industry experts to share their insights and help providers stay compliant.

Agreed. Proactive education and training on the FCA can go a long way in preventing costly enforcement actions down the line.