Listen to the article

Real-Name Identification Policy Reduces Information Quality on Chinese Social Media

A significant drop in the quality and predictive value of financial information shared on Chinese social media platforms has been linked to the implementation of mandatory real-name identification policies, according to a comprehensive new study.

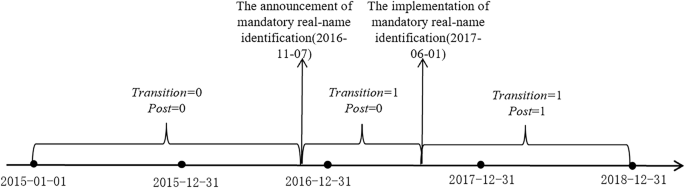

Researchers examining social media content before and after China’s 2017 back-end real-name identification policy found that user behavior changed dramatically once posters could no longer remain truly anonymous, even if their public usernames didn’t reveal their identity.

The study focused on financial discussions preceding corporate earnings announcements, measuring how accurately social media sentiment predicted companies’ unexpected earnings before and after the policy change.

“After the implementation of mandatory real-name identification, social media postings show a significant decrease in the ability to predict unexpected earnings,” the researchers noted. The effect was substantial, with predictive capacity declining by approximately 69% following the policy implementation.

This “chilling effect” appears to stem from users becoming more cautious about what they share, fearing potential regulatory consequences now that their real identities are linked to their online activities.

The researchers used advanced AI tools to classify users based on whether they already voluntarily disclosed identifying information on their profiles. Interestingly, the policy primarily affected those who had previously remained anonymous. Users who had already used their real names or identifiable information in their public profiles showed no significant change in posting behavior or information quality.

Users with large follower counts demonstrated the most pronounced decline in information sharing. As one researcher explained, “High-follower social media users may face higher risks when expressing their opinions after the mandatory real-name identification,” making them particularly cautious about sharing potentially valuable financial insights.

Content analysis revealed substantive changes in posting behavior. After the policy implementation, users became significantly less likely to make predictions about companies’ future performance, use definitive statements, or express personal opinions.

The capital market impacts were equally telling. Before the policy, social media postings demonstrably influenced stock prices, trading volumes, and bid-ask spreads. After implementation, these market effects weakened considerably, suggesting that valuable information was no longer being shared and incorporated into market pricing.

Traditional media, which was not subject to the same identification requirements, showed no similar decline in information quality, further strengthening the case that the real-name policy was responsible for the observed changes.

The effects were not uniform across all companies. Posts about centrally-owned state enterprises showed the most significant decline in information quality, likely because users perceived higher regulatory risks when discussing firms directly connected to central government agencies. Similarly, discussions about larger companies and those in regions with stronger legal environments saw greater information decline, suggesting users were more cautious when posting about entities with more resources to pursue potential legal action.

This research provides important insights for policymakers globally as they consider similar identification requirements. While such policies may reduce harmful anonymous content, they may simultaneously diminish the valuable information-sharing function of social media platforms, potentially affecting market efficiency and information flow.

“The mandatory real-name identification primarily affects the sentiment of front-end anonymous users,” the researchers concluded, highlighting the delicate balance between promoting accountability

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

28 Comments

Production mix shifting toward Fake Information might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Production mix shifting toward Fake Information might help margins if metals stay firm.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Nice to see insider buying—usually a good signal in this space.

If AISC keeps dropping, this becomes investable for me.

Production mix shifting toward Fake Information might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Uranium names keep pushing higher—supply still tight into 2026.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.