Listen to the article

President Trump’s Tax Claims Challenged by Independent Analyses

Independent tax experts have challenged President Donald Trump’s repeated claims that Americans will face a “68% tax increase” if the Republican budget bill, known as the One Big Beautiful Bill Act, fails to pass Congress.

The Urban-Brookings Tax Policy Center estimates that if the 2017 Tax Cuts and Jobs Act (TCJA) provisions expire at the end of this year as scheduled, Americans would see their taxes rise by approximately 7.5% on average – significantly lower than the president’s assertion.

“Overall, taxes would increase by an average of about $2,100, reducing after-tax income by 2.1 percent,” explained Joseph Rosenberg, a senior fellow at the Urban Institute who researches federal tax issues at the Tax Policy Center. “That corresponds to roughly a 7.5 percent increase in taxes, on average.”

The White House did not respond to requests for clarification on the source of Trump’s figure. However, analysts suggest he may be referring to the percentage of Americans who would experience some tax increase if the cuts expire, rather than the average size of the increase – a crucial distinction not made clear in his public statements.

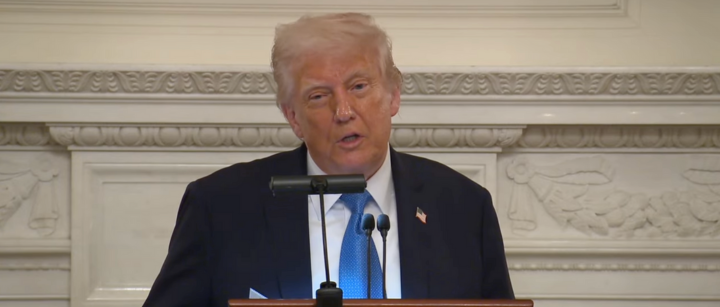

Speaking to reporters on May 25, Trump stated, “If the Democrats don’t vote, it’s a 68% tax increase.” He doubled down on this claim in a May 30 press conference, adding, “You’re going to go up 68%. That’s a number that nobody’s ever heard of before. You’ll have a massive tax increase.”

Independent analyses do indicate that a majority of Americans would see higher taxes without an extension of the TCJA provisions. The Tax Policy Center estimates 64.2% of households would pay more taxes in 2026 if the law expires. Similarly, the Tax Foundation puts this figure at 62% of tax filers.

Kentucky Republican Rep. Andy Barr articulated this interpretation in a CNN interview on May 21, stating that anyone voting against the bill is “voting for a $4 trillion tax increase, a tax increase on 68% of Americans.”

The Republican-sponsored bill would extend key provisions of the 2017 TCJA that are set to expire at the end of 2024. Without an extension, individual income tax rates would revert to their 2017 levels.

A Tax Foundation analysis examined the potential impact of the bill on after-tax income, finding that if passed, those in the bottom 40% of income levels – earning less than $37,364 – would see a 2.8% to 3.3% increase in after-tax income. Middle-income earners ($37,364-$71,067) would experience a 2.5% increase, while the top 20% (earning more than $125,315) would see a 3.8% gain.

The bill narrowly passed the House by a vote of 215-214, with all Democrats and two Republicans opposing it. President Trump’s comments notably overlook that Democrats have advocated extending the tax cuts for most Americans but oppose extending them for high-income earners.

Kent Smetters, a professor of business economics and public policy at the University of Pennsylvania, confirmed that according to Penn Wharton Budget Model analysis, “a bit more than half of households would see their tax bill increase” without new legislation.

The debate over these tax provisions comes at a critical time for American taxpayers and highlights the significantly different approaches between the parties on tax policy. While Republicans seek to extend all provisions of the 2017 tax law, Democrats have focused on maintaining cuts for lower and middle-income Americans while allowing increases on higher earners to help address budget concerns.

As the legislation moves to the Senate, the contrasting claims about its impact will likely continue to shape the political discourse around tax policy in this election year.

Verify This Yourself

Use these professional tools to fact-check and investigate claims independently

Reverse Image Search

Check if this image has been used elsewhere or in different contexts

Ask Our AI About This Claim

Get instant answers with web-powered AI analysis

Related Fact-Checks

See what other fact-checkers have said about similar claims

Want More Verification Tools?

Access our full suite of professional disinformation monitoring and investigation tools

7 Comments

Solid fact-checking work here. Appreciate the nuanced breakdown of the tax implications, especially the distinction between the average increase and the percentage of people affected. Helps provide a clearer, more accurate picture.

This is a fascinating dive into the details of Trump’s tax claims. It’s good to see independent analyses challenging the president’s figures and providing more nuanced insights on the potential impacts.

I’m skeptical of Trump’s 68% figure, but I’d be interested to hear the White House’s explanation for where that number came from. Even if it’s not the average impact, there may be some valid reasoning behind it that’s worth understanding.

Appreciate the breakdown of the estimated 7.5% average tax increase versus Trump’s assertion of a 68% hike. The distinction between the percentage of Americans affected versus the average increase is an important clarification.

You’re right, the framing and specifics matter a lot here. Looking at the average impact versus blanket percentages provides much more meaningful context.

This seems like a classic case of politicians making sweeping claims that don’t hold up under scrutiny. Good to see the media and independent experts pushing back and providing a more balanced, fact-based perspective.

Curious to know more about the Tax Policy Center’s analysis and methodology. What economic assumptions and data did they use to arrive at the 7.5% figure? And why do you think Trump cited such a dramatically higher number?