Listen to the article

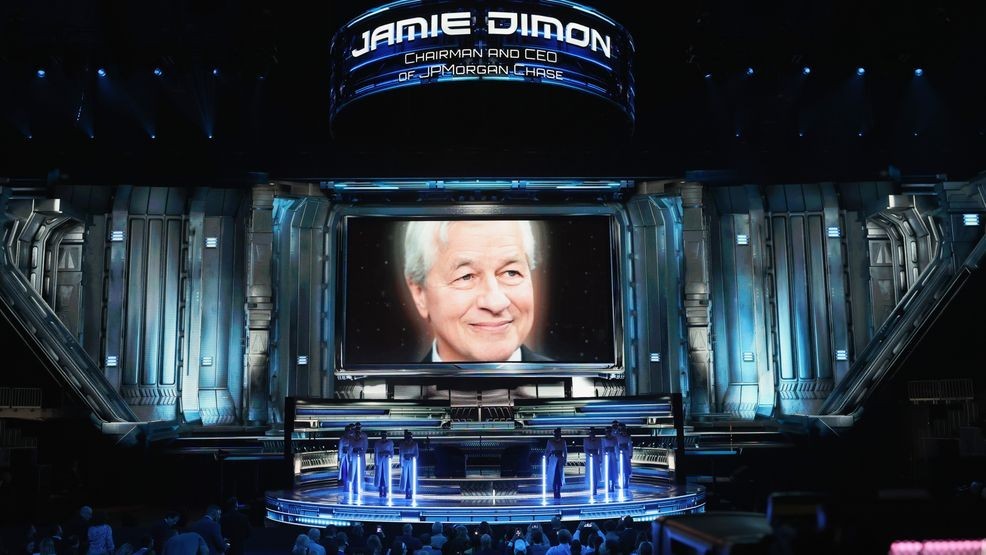

President Donald Trump has filed a $5 billion lawsuit against JPMorgan Chase and its CEO, alleging the bank shut down his accounts for political reasons following the January 6 Capitol riot.

The lawsuit centers on claims of “political debanking” – the allegation that Trump’s accounts were terminated solely because of his political views. Trump’s legal team argues this constitutes political discrimination and represents an abuse of financial power by one of America’s largest banking institutions.

JPMorgan Chase has firmly denied these accusations. In a statement responding to the lawsuit, the bank said: “Our company does not close accounts for political or religious reasons. We do close accounts because they create legal or regulatory risk for the company.” The bank added that “rules and regulatory expectations often lead us to do so.”

The high-profile case highlights ongoing tensions between banking regulations, consumer rights, and financial institutions’ risk management responsibilities. Financial institutions operate under strict regulatory frameworks that require them to monitor customer activity and mitigate potential risks to the banking system.

A recent analysis by the U.S. Senate Committee on Banking, Housing, and Urban Affairs found that debanking affects thousands of consumers and businesses nationwide, creating substantial hardships. The Senate report emphasized that while regulators could strengthen consumer protections, existing rules primarily protect financial institutions and the government from risk, rather than guarantee banking access for all customers.

Trump’s lawsuit emerges amid growing debate about whether banks discriminate against conservatives or religious groups. However, new research from the Cato Institute suggests the reality is more nuanced than many public narratives suggest.

After reviewing public cases and complaint data, Cato researchers concluded most debanking incidents stem not from political or religious discrimination but from government pressure on banks, both direct and indirect. “The majority of cases over time can be found where government officials have intervened in the market by either directly or indirectly telling banks how to run their business,” the report states.

Banks face a difficult balancing act under current regulations. Federal law requires financial institutions to monitor customers for suspicious activity and maintain strict anti-money laundering programs. Simultaneously, other regulations often prohibit banks from disclosing specific reasons for account closures. This lack of transparency frequently fuels accusations of discrimination, even when closures stem from compliance concerns.

The Cato Institute’s analysis categorizes debanking into four types: governmental debanking (when government agencies pressure banks), operational debanking (internal business decisions based on contract violations or reputational concerns), political debanking (closures based solely on political beliefs), and religious debanking (closures based solely on faith). According to their research, the first two categories account for most cases.

To test claims of widespread political or religious targeting, Cato points to a Reuters review of 8,361 account-closure complaints filed with federal regulators. Only 35 complaints mentioned terms like “politics,” “religion,” “conservative,” or “Christian,” suggesting such discrimination may be less common than public discourse indicates.

The case against JPMorgan Chase represents one of the most high-profile banking disputes in recent years and could have significant implications for how financial institutions manage politically exposed customers. It also raises important questions about the boundaries between legitimate risk management and discrimination.

Financial industry analysts note that large banks like JPMorgan Chase typically have robust protocols for account closures, particularly for high-profile customers. Such decisions usually involve multiple layers of review and legal consultation before implementation.

As the lawsuit proceeds through the court system, it will likely spark broader discussions about banking access, the rights of financial institutions to manage risk, and the appropriate role of government oversight in the banking sector. The outcome could potentially influence future banking regulations and practices across the industry.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

6 Comments

I’m curious to learn more about the specifics of this case and the regulatory frameworks that financial institutions operate under. It seems there could be nuances around risk management vs. political bias.

Agreed, the banking regulations are likely a key factor here. It will be important for the courts to closely examine whether the bank’s actions were solely driven by legal/regulatory requirements or if there was any political motivation involved.

The outcome of this case could have broader implications for how financial institutions manage customer relationships and political risk. I’ll be following this closely to see how the legal arguments unfold.

This highlights the delicate balance banks must strike between complying with rules and avoiding any appearance of unfair treatment. It will be a challenge for the court to determine if political discrimination occurred.

This is a complex legal case with valid concerns on both sides. It will be interesting to see how the courts weigh the bank’s regulatory obligations against allegations of political discrimination.

Given the high-profile nature of this dispute, I hope both sides present their cases objectively and the court renders a fair and impartial decision based on the evidence.