Listen to the article

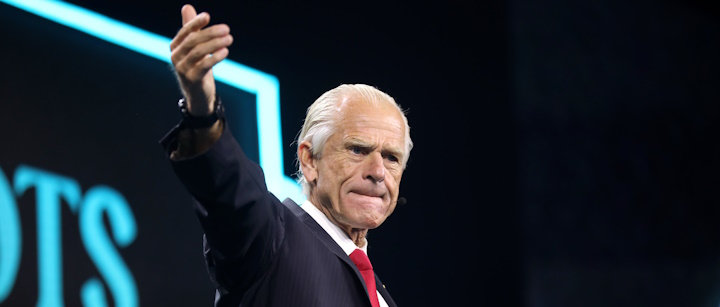

In a striking contradiction to White House trade adviser Peter Navarro’s claims, economic analyses suggest that tariffs announced by President Donald Trump this year would generate significantly less revenue than the $6-7 trillion figure Navarro recently cited.

During an April 6 interview on Fox News’ “Sunday Morning Futures,” Navarro boldly claimed that Trump’s tariffs would raise “$600, $700 billion they are going to raise a year, $6 to $7 trillion over the 10-year period.” He asserted these funds would “help pay for the tax cuts” and insisted that “every single dollar” of tariff revenue taken “from the foreigners who have been cheating us” would benefit Americans through tax cuts and debt reduction.

However, multiple independent economic groups paint a vastly different picture. The Tax Policy Center projects the tariffs would raise approximately $3.5 trillion over the next decade—just over half of Navarro’s estimate. Similarly, the Tax Foundation forecasts $2.2 trillion in revenue over ten years on a conventional basis, dropping to $1.6 trillion when accounting for negative economic effects.

Other respected institutions offer comparable projections. The Committee for a Responsible Federal Budget estimates $3 trillion from 2025 to 2034, potentially declining to $2.7 trillion when factoring in macroeconomic effects. Yale University’s Budget Lab suggests $3.1 trillion between 2026 and 2035, falling to $2.5 trillion after accounting for negative revenue impacts. The Penn Wharton Budget Model provides the highest estimate at $4.6 trillion over a decade, which could decrease to $4.13 trillion with lower economic growth.

Economic experts also challenge Navarro’s characterization of who pays for tariffs. Contrary to his claim that “foreigners” would foot the bill, tariffs are actually paid by U.S. importers, not foreign countries. These importers frequently pass costs to American consumers through price increases, making tariffs effectively regressive taxes that disproportionately burden lower-income households.

Howard Gleckman, a senior fellow at the Tax Policy Center, speculated that Navarro’s calculation might have simply multiplied the $3.3 trillion in U.S. goods imports by a rough 20% tariff rate. “Simple. But wrong,” Gleckman noted in an April 8 blog post, adding that Trump’s tariffs would “likely fall far short of Navarro’s prediction.”

This revenue shortfall creates significant doubt about funding Trump’s economic agenda. The Congressional Budget Office estimates that extending the individual tax cuts from the 2017 Tax Cuts and Jobs Act alone would cost $4 trillion over ten years—exceeding most projections of tariff revenue.

The White House did not respond to requests for clarification on Navarro’s revenue projections or whether they formed the basis for President Trump’s April 8 claim that his tariffs are bringing in “$2 billion a day.”

On April 9, President Trump announced a 90-day suspension of some of his recently announced “reciprocal” tariffs. Currently, goods imported from China face a 125% tariff, while a universal 10% tariff applies to all imported goods from other countries.

Economic analyses also warn of additional concerns not reflected in basic revenue projections. The Tax Foundation notes that tariffs could reduce U.S. GDP by 0.8% before considering potential foreign retaliation. Several countries have already announced retaliatory tariffs on U.S. goods, which could further diminish economic growth, corporate profits, and wages for American workers.

As the 90-day pause period progresses, economists and policymakers will closely monitor which tariffs ultimately take effect and their actual revenue generation, which appears likely to fall significantly short of the administration’s projections.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

7 Comments

The wide gap between the White House’s tariff revenue estimate and those of independent groups raises serious questions. Rigorous, nonpartisan economic modeling is essential for understanding the true costs and benefits of trade policies.

Agreed. Policymakers should rely on authoritative, impartial sources when assessing the fiscal and economic implications of major trade actions. Transparency and accountability are critical.

This is a timely and important fact check. While tariffs may aim to protect certain domestic industries, the overall revenue impact appears to be much lower than the administration’s claims. Nuanced, evidence-based analysis is needed.

This highlights the importance of scrutinizing political claims, especially when they diverge significantly from respected analyses. Fact-checking and independent verification are crucial for informed public discourse on economic issues.

Interesting analysis challenging the White House’s tariff revenue claims. It’s important to rely on objective, independent economic assessments rather than overly optimistic political rhetoric.

The discrepancy between the government’s projections and those of other respected institutions is quite striking. It highlights the need for thorough, impartial analysis of the potential economic impacts of tariffs.

Absolutely. Policymakers should base decisions on credible, data-driven forecasts rather than unfounded speculation. Transparent, fact-based dialogue is crucial for sound economic policy.