Listen to the article

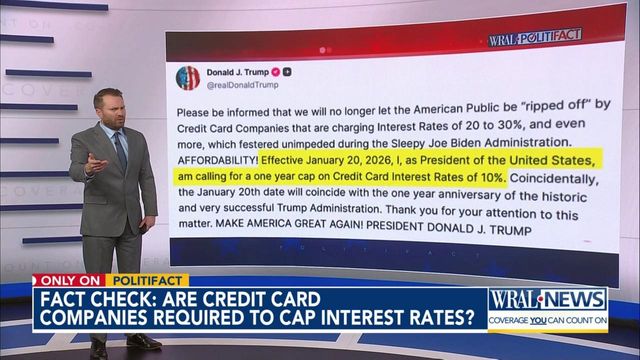

A wave of social media posts claiming credit card companies are legally required to cap interest rates at 10% has sparked confusion among consumers nationwide. These viral claims, which have circulated widely on platforms like TikTok and Facebook, suggest that cardholders can simply call their issuers and request this lower rate, citing an alleged federal law.

Financial experts and consumer advocates have quickly moved to debunk this misinformation. There is no federal law mandating credit card companies to cap interest rates at 10%, regardless of what consumers might request.

“This is completely false information that could lead consumers to make poor financial decisions,” said Ted Rossman, senior industry analyst at Bankrate. “Credit card interest rates are actually at record highs, averaging over 20% nationwide, and there’s no legal mechanism forcing banks to lower them upon request.”

The confusion appears to stem from misunderstandings about the Credit Card Accountability Responsibility and Disclosure Act of 2009, commonly known as the CARD Act. While this legislation did introduce important consumer protections around credit card practices, it did not establish any federal interest rate caps.

The CARD Act primarily focused on transparency, requiring clearer disclosures about terms and conditions, limiting certain fees, and restricting how and when card issuers could raise rates on existing balances. At no point did it mandate maximum interest rates.

Currently, the average credit card interest rate in the United States hovers around 24%, according to data from the Federal Reserve. This represents a significant increase from just a few years ago, driven by the Federal Reserve’s aggressive interest rate hikes aimed at combating inflation.

Some states do have usury laws that cap interest rates, but these vary widely and typically include numerous exceptions for nationally chartered banks and credit card issuers. Additionally, most major card issuers are headquartered in states with favorable banking regulations, such as Delaware and South Dakota, which allow them to charge higher rates.

“The spread of this misinformation is particularly concerning given today’s high-interest environment,” said Chi Chi Wu, staff attorney at the National Consumer Law Center. “Consumers facing high credit card debt need accurate information about their options, not false promises of easy solutions.”

For consumers struggling with high-interest credit card debt, legitimate options do exist. Many card issuers offer hardship programs for customers experiencing financial difficulties, though these are discretionary and not mandated by law. Balance transfer cards with promotional 0% interest periods remain available for those with good credit scores.

Credit counseling agencies can also help negotiate lower rates in some cases, though this typically involves enrolling in a debt management plan with specific terms and conditions.

The Consumer Financial Protection Bureau (CFPB) recommends consumers start by directly contacting their credit card companies if they’re struggling to make payments, but warns against approaching these conversations with false expectations about guaranteed rate reductions.

“While negotiating with your card issuer is always worth trying, entering that conversation with incorrect information about federal laws will undermine your credibility and potentially harm your chances of getting meaningful assistance,” a CFPB spokesperson noted in a recent statement.

Financial literacy experts point to this viral misinformation as evidence of the widespread confusion about credit card regulations and consumer rights. They emphasize the importance of seeking information from reliable sources like the CFPB, Federal Trade Commission, or established financial news outlets.

As interest rates remain elevated, consumers are advised to focus on debt reduction strategies based on accurate information rather than unverified social media claims. This includes prioritizing high-interest debt, considering balance transfers when appropriate, and understanding the actual terms of their credit agreements.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

8 Comments

This is an important fact check. Credit card interest rates are quite high these days, so it’s understandable why people might wish there was a legal cap. However, as the experts explain, no such law exists. Cardholders should be aware of the actual terms and conditions of their accounts.

Interesting, I wasn’t aware of this misinformation. It’s good that financial experts are quickly working to debunk these false claims. Consumers should be cautious about viral social media posts that make unsupported legal claims.

Hmm, I wonder what’s driving the confusion around the CARD Act and interest rate caps. While the legislation did introduce some important protections, it seems the viral claims about a 10% cap are simply inaccurate. Good to know the truth from reliable sources.

You raise a good point. The CARD Act was likely misinterpreted by some as establishing an interest rate cap, when in reality it did not. Misinformation can spread quickly online, so it’s important for people to fact-check claims, especially about financial regulations.

Thanks for sharing this information. It’s concerning to see misinformation spreading about consumer financial regulations. I appreciate the clarity provided by the financial experts quoted in the article. Fact-checking is crucial to prevent people from making poor decisions based on false claims.

This is an important clarification. While the CARD Act did introduce some protections, it did not establish any federal mandate for credit card companies to cap interest rates at 10%. Consumers should be wary of viral social media claims that seem too good to be true.

It’s frustrating to see this kind of misinformation circulating, especially on topics that can have real financial consequences for consumers. I’m glad the experts are setting the record straight. Fact-checking is so crucial these days to combat the spread of false claims.

Interesting to learn about the origins of this misinformation. It sounds like the confusion stems from misunderstandings about the CARD Act. I appreciate the financial experts weighing in to provide accurate information and prevent people from making poor decisions.