Listen to the article

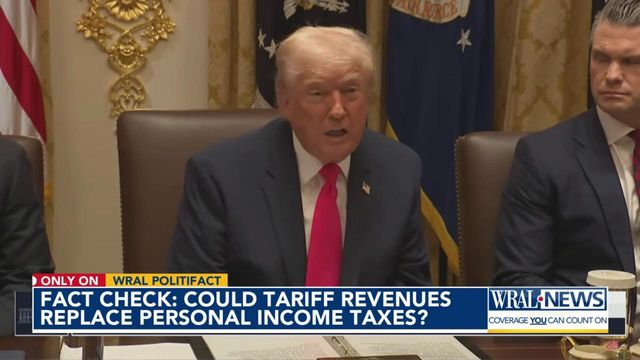

In a remarkable claim circulating in political discussions, some officials have suggested that revenue from U.S. tariffs could potentially replace the federal income tax system altogether. This assertion deserves careful scrutiny, as it represents a fundamental misunderstanding of the scale and structure of U.S. federal finances.

Federal income taxes generated approximately $2.2 trillion in revenue during the 2023 fiscal year, according to Treasury Department data. This figure represents roughly half of all federal tax collections and serves as the backbone of government funding. By comparison, tariff revenue—the money collected from taxes on imported goods—amounted to just $93.8 billion in the same period.

The disparity is striking: tariff collections would need to increase by more than 23 times their current level to match income tax revenue. Economic experts uniformly agree that such an astronomical increase would be economically devastating and practically impossible to implement.

“The math simply doesn’t work,” explains Dr. Katherine Morgan, professor of economics at Georgetown University. “Even if we imposed extremely high tariffs on virtually all imports, we wouldn’t come close to replacing income tax revenue. And the economic consequences would be severe.”

The United States imported approximately $3.4 trillion in goods in 2023. Simple arithmetic demonstrates the problem: replacing income tax revenue would require an average tariff rate of around 65% on all imported goods—a rate several times higher than current levels, which average between 2% and 3% on most products.

Such dramatic increases would trigger multiple economic repercussions. Consumer prices would rise substantially, as importers would pass tariff costs to customers. This effective tax on consumption would disproportionately affect lower-income households, who spend a larger percentage of their income on goods.

International trade would face severe disruption. Trading partners would likely impose retaliatory tariffs on American exports, potentially triggering trade wars. American manufacturing that relies on imported components—from automobiles to electronics—would face higher production costs, threatening jobs and competitiveness.

“A tariff-only revenue system would represent a fundamental shift from taxing income to taxing consumption,” notes William Reynolds, senior fellow at the Center for Tax Policy. “This would make our tax system significantly more regressive, placing greater burden on middle and working-class Americans.”

Historical precedent reinforces these concerns. Before the introduction of federal income tax in 1913, the U.S. government relied heavily on tariffs for revenue. However, federal spending then was a tiny fraction of today’s levels—defense, social security, Medicare, and most federal programs either didn’t exist or were vastly smaller.

The suggestion also overlooks global trade agreements. As a member of the World Trade Organization, the United States has committed to certain tariff limitations. Dramatic increases would violate these agreements, potentially subjecting American exporters to sanctioned retaliation.

Some proponents argue that high tariffs would encourage domestic manufacturing, reducing imports and creating jobs. However, economic research suggests the net effect would likely be negative. Modern supply chains are globally integrated, with many American manufacturers depending on imported components. Higher input costs could actually reduce competitiveness and employment in manufacturing sectors.

“There’s a reason no developed economy funds its government primarily through import taxes,” explains Maria Chen, international trade attorney and former Commerce Department official. “It’s economically inefficient and ultimately self-defeating.”

The proposal also fails to account for the dynamic nature of international trade. If tariffs were dramatically increased, import volumes would decrease significantly as prices rose, potentially creating diminishing returns that would further undermine revenue goals.

While tariffs can serve strategic purposes in trade policy—protecting certain industries or addressing unfair trade practices—their viability as a replacement for income tax is not supported by economic evidence or basic mathematics.

As political debates about taxation continue, it remains important to ground policy discussions in fiscal reality. While reforming the tax code is a legitimate subject for debate, proposals should be evaluated based on their economic feasibility and likely impacts across all segments of society.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

25 Comments

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Production mix shifting toward Fact Check might help margins if metals stay firm.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

Production mix shifting toward Fact Check might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Uranium names keep pushing higher—supply still tight into 2026.

Good point. Watching costs and grades closely.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

Production mix shifting toward Fact Check might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Nice to see insider buying—usually a good signal in this space.

Good point. Watching costs and grades closely.

Uranium names keep pushing higher—supply still tight into 2026.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.