Listen to the article

Berkshire Hathaway Signals Potential Sale of Entire Kraft Heinz Stake Under New Leadership

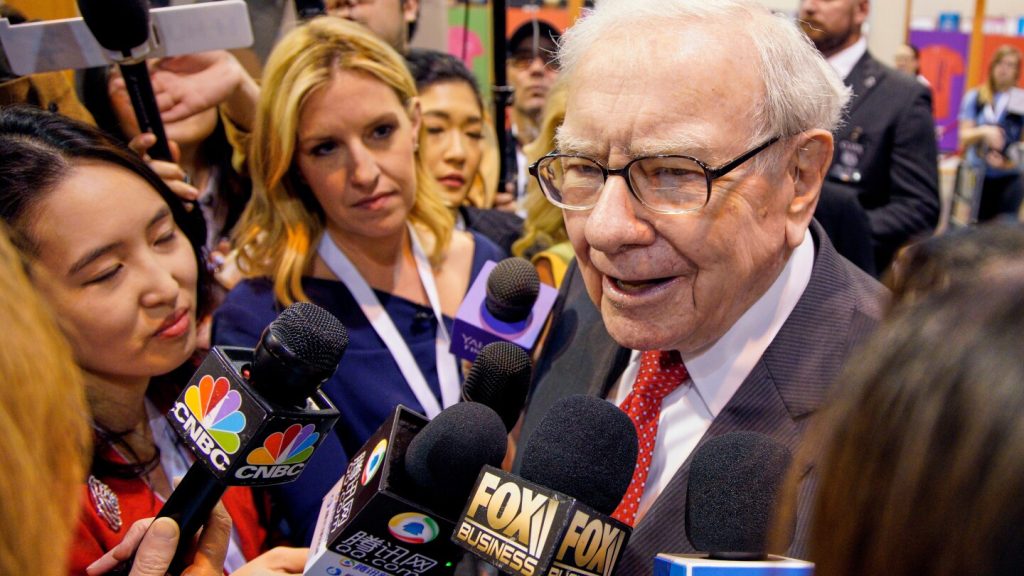

Warren Buffett’s successor appears to be considering his first major strategic move since taking the helm at Berkshire Hathaway earlier this month. Kraft Heinz revealed in a regulatory filing Tuesday that Berkshire Hathaway may be looking to divest its entire 325 million share position in the food manufacturing giant – a holding that represents one of the conglomerate’s most prominent investments.

The potential sale marks a significant shift from the strategy pursued by Buffett, who helped engineer the 2015 merger between Kraft and Heinz alongside Brazilian investment firm 3G Capital. Both Berkshire and 3G had previously owned Heinz and believed in the enduring power of the combined company’s household brands.

Kraft Heinz shares dropped nearly 4% to $22.85 following the announcement, reflecting investor concern about what would happen if Berkshire unloaded its massive stake, which currently represents approximately 26% of the company’s outstanding shares.

The move appears to signal a strategic reassessment under Greg Abel, who officially succeeded Buffett as CEO on January 1. While Buffett remains chairman of Berkshire Hathaway, the potential divestiture suggests Abel may be charting a different course from his predecessor’s famous buy-and-hold approach.

Industry analysts note that Buffett’s enthusiasm for Kraft Heinz had diminished in recent years as consumer preferences shifted toward fresher foods and store brands, eroding the competitive moat he once believed protected the company’s iconic products. Last summer, Berkshire took a $3.76 billion writedown on its Kraft Heinz stake, a clear acknowledgment of the declining value of the investment.

Signs of strain in the relationship became more evident when Berkshire’s two representatives resigned from the Kraft Heinz board last spring. Buffett also publicly expressed disappointment in the company’s plan to split into two separate entities.

“My sense is that Greg Abel’s leadership style may be a departure from Buffett’s, and this sale, if completed, would represent a shift in corporate mindset,” said CFRA Research analyst Cathy Seifert. “Berkshire under Buffett typically only made acquisitions – not divestitures. It’s not inconceivable, in our view, that Abel may likely assess every Berkshire subsidiary and decide to jettison those that do not meet his internal hurdles.”

The potential divestiture could represent just the beginning of a comprehensive review of Berkshire’s diverse portfolio. The conglomerate holds a stock portfolio worth over $300 billion, alongside ownership of numerous businesses including Geico insurance, several utilities, BNSF railroad, and various manufacturing and retail companies.

Chris Ballard, managing director at investment firm Check Capital, characterized the potential Kraft Heinz sale as “probably the most low-hanging fruit for Greg” and added that his firm “wouldn’t be sad to see the holding go.”

However, executing such a large sale presents logistical challenges. With 325 million shares to potentially divest, Berkshire would face difficulty unloading its entire position on the open market without significantly depressing the share price. This has led to speculation about whether a large institutional buyer might be waiting in the wings.

Any potential block sale would need to adhere to principles Buffett established last fall, when he stated that Berkshire wouldn’t accept a block bid for its shares unless the same offer was extended to all Kraft Heinz shareholders – maintaining his longstanding commitment to treating all investors equitably.

While Berkshire Hathaway has not yet responded to questions about the regulatory filing, the market will be watching closely to see how Abel navigates this potential divestiture and what it might signal about his broader vision for the legendary investment conglomerate’s future.

The situation also underscores the broader challenges facing traditional packaged food companies as they grapple with changing consumer preferences, inflation pressures, and increased competition from nimble startups and private label alternatives.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

8 Comments

The potential sale of Berkshire’s Kraft Heinz stake is a bold move. Buffett was a big believer in the company, so this suggests Greg Abel may have a different investment philosophy. It will be interesting to see what he does with the proceeds and where Berkshire focuses next.

Berkshire’s potential exit from Kraft Heinz is a significant development. The consumer packaged goods sector has faced headwinds, so this may be a strategic move to reallocate capital to more promising areas. It will be worth watching how Kraft Heinz’s performance is impacted if Berkshire sells off its large stake.

The Kraft Heinz investment has long been associated with Buffett’s investment approach. If Berkshire does divest, it could mark a shift in priorities under the new leadership. I’m curious to see if this is part of a broader portfolio review or a more targeted move related to this specific company.

Interesting move by Berkshire Hathaway’s new leadership. Kraft Heinz has been a major investment, so it will be telling to see if they decide to fully divest or just trim their stake. This could signal a shift in Berkshire’s portfolio strategy under the new CEO.

Berkshire’s potential sale of its Kraft Heinz stake is a notable development. While Buffett was a long-time believer in the company, the new leadership may have a different view on its prospects. This could signal a broader portfolio reassessment as Berkshire adapts to the changing business environment.

I’m curious to see how the market reacts if Berkshire does sell off its Kraft Heinz shares. The food and consumer goods giant has faced some challenges in recent years, but it’s still a major player. This decision could have wider implications for the sector.

This potential Kraft Heinz divestment is an intriguing strategic move by Berkshire. The food and consumer goods space has been challenging, so it makes sense they may want to redeploy that capital elsewhere. It will be interesting to see if this is the start of more significant changes under the new CEO.

Kraft Heinz has certainly had its ups and downs over the years. I wonder if Berkshire feels the company’s brands and market position aren’t as strong as they once were, leading to this potential divestment. It could be a prudent portfolio rebalancing or a sign of bigger changes ahead.