Listen to the article

Ryanair CEO Michael O’Leary has dismissed Elon Musk’s suggestion of purchasing the budget airline, escalating a public feud that began over satellite internet technology for aircraft.

The war of words between the outspoken Irish airline executive and the world’s richest person erupted last week when O’Leary stated that Ryanair had ruled out installing Musk’s Starlink satellite Wi-Fi system on its aircraft. According to O’Leary, the additional fuel costs resulting from the aerodynamic drag of Starlink’s antennas would be prohibitively expensive for the low-cost carrier.

After Musk accused him of being “misinformed” about the technology, O’Leary escalated the conflict during an interview with an Irish radio station, calling Musk “an idiot” whose opinions should be disregarded. Musk responded on his social media platform X, labeling O’Leary an “utter idiot” and an “imbecile,” before polling his followers on whether he should “buy Ryan Air and put someone whose actual name is Ryan in charge.” The poll received over 76% affirmative responses.

Speaking to reporters in Dublin, O’Leary pointed out the regulatory impossibility of Musk’s proposal, noting that non-European citizens cannot own a majority stake in European airlines. Musk, born in South Africa and residing in the United States, would face significant regulatory hurdles in such an acquisition attempt.

“But if he wants to invest in Ryanair, we would think it’s a very good investment. Certainly a significantly better investment than the financial returns he’s earning on X,” O’Leary quipped, referencing Musk’s controversial $44 billion acquisition of the platform formerly known as Twitter in 2022.

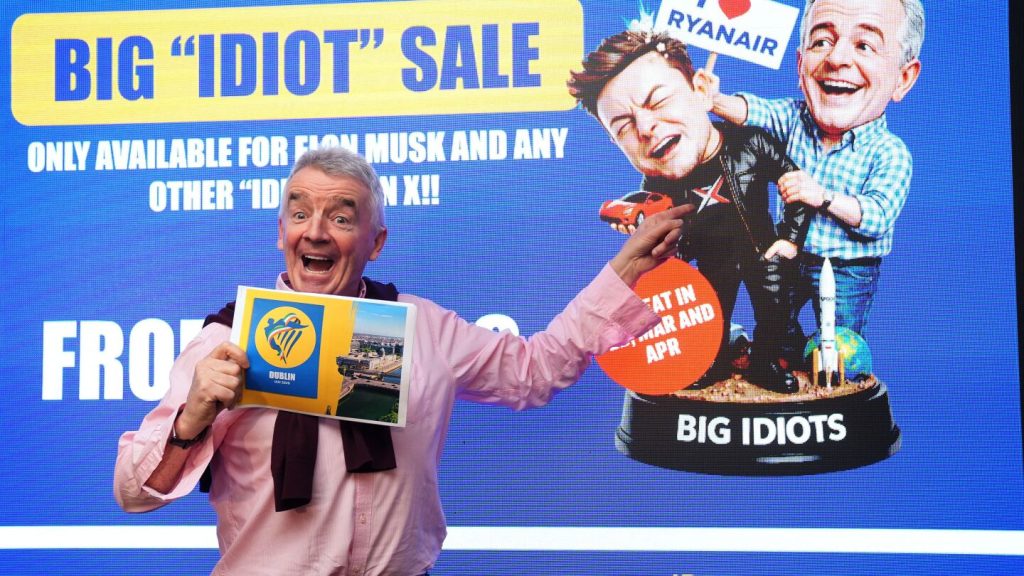

The Ryanair CEO, known for his provocative public persona, appeared unfazed by the billionaire’s insults, stating that Musk “would have to join the back of a very, very, very, very long queue of people” who have insulted him, including his “four teenage children.” The airline has even capitalized on the publicity from the dispute by launching a seat sale featuring a caricature of Musk.

Despite the heated exchange, O’Leary clarified that Ryanair had been in discussions with Starlink for approximately 12 months and praised the technology itself. “We like the Starlink system. It is a terrific system. It works very well,” he said. However, he estimated that implementing the system would cost the company about $250 million annually, including installation costs and an additional $200 million in fuel expenses due to the 2% increase in aerodynamic drag from the antennas.

Starlink has emerged as a major player in the in-flight connectivity market, with more than two dozen airlines worldwide having either signed deals or announced plans to use the satellite network. The roster includes major carriers like British Airways, Korean Air, and United Airlines, as well as budget airlines such as Vueling. Several airlines already offer the service on active routes, including Qatar Airways, Canada’s WestJet, and Hawaiian Airlines, which became the first major carrier to implement Starlink’s Wi-Fi in February 2024.

O’Leary noted that Ryanair would need to charge for the Starlink service but estimated that fewer than 5% of passengers would be willing to pay extra for internet access on the airline’s short-haul flights, which average about one hour and 15 minutes.

The airline continues to explore other options, including discussions with Amazon’s competing Kuiper satellite project, but O’Leary emphasized that any connectivity solution would need to “lower our costs” to be viable for Ryanair’s business model.

In his remarks, O’Leary also criticized Musk’s social media platform X, particularly regarding recent controversies surrounding Musk’s AI chatbot Grok, which has been used to generate nonconsensual deepfake images. “Social media, X in particular is, a cesspit,” O’Leary stated. “The most recent controversy with, you know, undressing children or undressing women is frankly offensive.”

The public spat highlights the increasing competitive landscape for in-flight connectivity solutions as airlines evaluate the cost-benefit analysis of various satellite internet providers against their specific business models and customer expectations.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

24 Comments

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

I like the balance sheet here—less leverage than peers.

Exploration results look promising, but permitting will be the key risk.

I like the balance sheet here—less leverage than peers.

Interesting update on Ryanair CEO dismisses Elon Musk’s idea of buying the airline as verbal feud escalates. Curious how the grades will trend next quarter.

Good point. Watching costs and grades closely.

Production mix shifting toward Business might help margins if metals stay firm.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.

Interesting update on Ryanair CEO dismisses Elon Musk’s idea of buying the airline as verbal feud escalates. Curious how the grades will trend next quarter.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Silver leverage is strong here; beta cuts both ways though.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.