Listen to the article

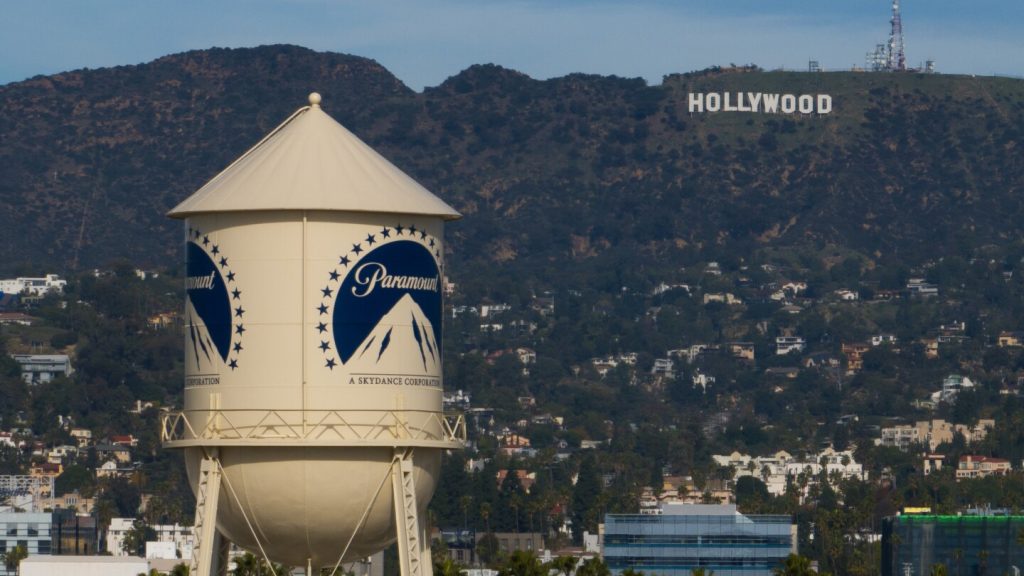

Hollywood’s $70 Billion Battle: Netflix and Paramount Fight for Warner Bros. Discovery

Warner Bros. Discovery finds itself at the center of a high-stakes bidding war between streaming giant Netflix and newly merged Paramount-Skydance, setting the stage for one of the most consequential media consolidations in recent history.

On Wednesday, Warner’s board formally recommended shareholders accept Netflix’s $72 billion offer to acquire the company’s studio and streaming operations. This move came despite Paramount’s aggressive counteroffer—a hostile $77.9 billion bid for complete control of Warner Bros. Discovery, including its valuable cable networks like CNN.

Either deal would dramatically reshape Hollywood’s landscape, but industry experts warn that a lengthy regulatory process awaits. The U.S. Justice Department will likely scrutinize both proposals intensely, with reviews potentially stretching beyond a year as regulators assess competitive implications across streaming, content production, and news media.

“The broader you make the market that we’re thinking about, the less the merger looks anti-competitive,” explains Jim Speta, professor at Northwestern University’s Pritzker School of Law.

Adding an unprecedented layer of complexity, President-elect Donald Trump has suggested he may personally intervene in the approval process—a stance that has alarmed antitrust experts who note presidential involvement in specific merger decisions would break with long-established norms.

Hollywood’s Power Players

Warner Bros. Discovery, with its 102-year legacy, stands as one of Hollywood’s “big five” studios. The entertainment conglomerate boasts iconic franchises including “Harry Potter” and “Superman,” alongside premium cable assets like CNN and HBO. Following its own troubled merger just three years ago, Warner now finds itself being courted by two very different suitors.

Netflix, valued at approximately $430 billion, dominates the streaming landscape with about 20% of the U.S. subscription video-on-demand market. While primarily known for distribution, Netflix has steadily built its own production capabilities, creating global hits like “Squid Game” and “Stranger Things.” The company sees Warner’s extensive content library as complementary to its streaming ambitions.

Paramount, which recently completed an $8 billion merger with Skydance Media, represents another storied Hollywood legacy with franchises like “Top Gun” and “The Godfather.” Its media portfolio includes CBS, MTV, Nickelodeon, and the Paramount+ streaming service, which currently holds about 7% market share compared to HBO Max’s 13%.

Regulatory Hurdles Ahead

Both proposed deals face significant regulatory scrutiny, with antitrust concerns leading the way. Paramount has already targeted Netflix’s streaming dominance, arguing that combining Netflix with HBO Max would create “overwhelming” market concentration. Netflix counters that the merger would actually enhance consumer choice by allowing it to offer expanded content options.

Industry observers expect both companies to frame their market position broadly, pointing to competition not just from traditional media companies but from platforms like YouTube, which Nielsen data shows accounts for nearly 13% of overall viewership compared to Netflix’s 8%.

“The range of available content on the streaming services might decrease,” warns Scott Wagner, head of antitrust practice at law firm Bilzin Sumberg. He notes that certain content, particularly classic films, could see reduced availability or shortened streaming windows under either scenario.

Additional regulatory concerns include potential workforce reductions, content diversity, and the significant implications of media consolidation in the news sector. While Netflix’s deal would avoid news media concerns by excluding networks like CNN, Paramount’s full acquisition would bring both CNN and CBS under one corporate umbrella.

Wagner believes the news media aspect, while notable, likely won’t be the decisive factor in regulatory reviews. “Advocates of the Paramount merger will probably point to wider media offerings beyond traditional TV news, including information-sharing on social media platforms,” he explains.

Political Dimensions

The political context surrounding these deals adds another layer of complexity. Under its new Skydance ownership, Paramount has already made moves to appeal to conservative viewers in its news operations, including appointing Free Press founder Bari Weiss as editor-in-chief of CBS News.

Trump has openly discussed both deals, stating he would “be involved in that decision” and suggesting Netflix’s proposal “could be a problem” due to market share concerns. Trump also has connections to Oracle founder Larry Ellison, father of Paramount CEO David Ellison, whose family trust is heavily backing Paramount’s bid.

Meanwhile, Netflix has its own political ties, with Trump previously calling Netflix co-CEO Ted Sarandos a “fantastic man” and noting they had met in the Oval Office prior to the Warner merger announcement.

“Presidents picking whether mergers happen or don’t happen is completely unprecedented,” Speta emphasizes, highlighting the unusual nature of Trump’s suggested involvement.

Regardless of which company prevails, Paul Nary of the Wharton School warns that Warner Bros. Discovery itself could be damaged during a prolonged battle. “There’s a potential for the winner’s curse here,” he notes. “Media and entertainment is one of those spaces where you see all of these mega mergers—high stakes and big egos competing over glamorous assets. And so many of those deals end up failing.”

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

9 Comments

This acquisition battle shows how much value is placed on premium content and distribution capabilities in the streaming wars. I wonder how the regulators will balance promoting competition with enabling these companies to achieve scale.

That’s a great point. The regulators will have to carefully weigh the tradeoffs between consolidation and maintaining a healthy, competitive marketplace for consumers.

The potential merger between Warner Bros. Discovery and either Netflix or Paramount would undoubtedly reshape the media landscape. I’m curious to see how the regulatory review process unfolds and what concessions, if any, the companies may have to make.

Absolutely, the regulatory hurdles will be significant. It will be important for the Justice Department to ensure that these deals don’t create too much market concentration and limit consumer choice.

This is a fascinating battle unfolding in the media and entertainment space. The regulatory outlook will be critical as these major players jostle for control of valuable content and distribution assets.

You’re right, the antitrust scrutiny will be intense. Regulators will need to carefully weigh the competitive impacts across the entire industry.

The bidding war between Netflix and Paramount for Warner Bros. Discovery highlights the high stakes and rapid consolidation happening in streaming and media. It will be interesting to see how the regulators navigate this complex landscape.

Agreed, the regulatory process will be pivotal in shaping the future of the industry. The Justice Department will have a lot to consider in terms of market power and consumer choice.

This is a high-stakes battle for control of valuable content and distribution assets in the media industry. The regulatory outlook is crucial, as the Justice Department will need to carefully weigh the competitive implications.