Listen to the article

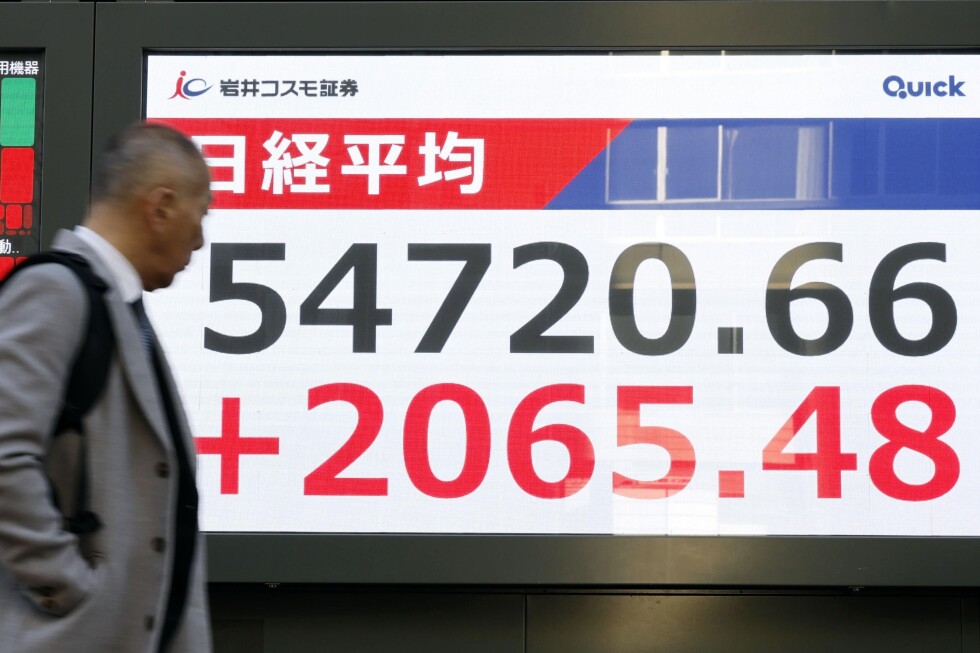

Global markets experienced a significant rally on Tuesday, with Asian indices leading the charge as investors flocked to technology-related shares. South Korea’s Kospi surged nearly 7% while Japan’s Nikkei 225 jumped 3.9% to reach a historic high.

The Nikkei 225 closed at 54,720.66 points, setting a new record as equipment manufacturers saw substantial gains. Disco Corp. shares climbed 7.4%, while testing equipment maker Advantest rose 7.1%. Market analysts attribute this bullish sentiment partly to political factors, as investors anticipate Prime Minister Sanae Takaichi’s Liberal Democratic Party will secure a significant majority in the upcoming February 8 election, potentially ushering in market-friendly policies.

Some economic observers, however, warn that Takaichi’s expected increase in government spending might further weaken the Japanese yen, creating challenges for consumers and certain business sectors.

South Korea’s market performance was equally impressive, with the Kospi reaching 5,288.08 points. Investor confidence appeared to recover after recent concerns about a potential artificial intelligence bubble. Technology giants led the rally, with Samsung Electronics Co. soaring 11.4% and chip manufacturer SK Hynix advancing 9.3%.

European markets also opened on a positive note. France’s CAC 40 gained 0.6% to 8,232.71, Germany’s DAX rose 1.0% to 25,053.90, and Britain’s FTSE 100 edged up 0.2% to 10,361.21. U.S. futures indicated a positive opening, with S&P 500 futures up 0.3% and Dow Jones Industrial Average futures rising 0.1%.

Investors are closely watching upcoming corporate earnings reports to assess the impact of various economic and political developments, including President Donald Trump’s tariff policies and potential restrictions on rare earth exports from China.

In other Asian markets, Hong Kong’s Hang Seng gained 0.2% to 26,834.77, while the Shanghai Composite added 1.3% to 4,067.74. Australia’s S&P/ASX 200 increased 0.9% to 8,857.10 after the country’s central bank raised its benchmark interest rate for the first time in two years, citing higher-than-anticipated inflation.

Monday’s trading in the U.S. had already shown positive momentum, with the S&P 500 adding 0.5% to break a three-day losing streak. The Dow industrials rose 1.1%, while the Nasdaq composite gained 0.6%.

Precious metals saw a remarkable rebound on Tuesday, with gold surging 6.7% and silver jumping nearly 14%. This recovery follows Friday’s dramatic sell-off, when silver prices plummeted 31.4%. Market analysts suggest the volatility in precious metals reflects investor concerns about several factors: potential changes to Federal Reserve independence following President Trump’s nomination of Kevin Warsh as the next Fed chair, elevated U.S. stock valuations, tariff threats, and growing government debt burdens globally.

The Federal Reserve chair’s position carries significant influence over global markets and economic conditions through monetary policy decisions that affect interest rates, which in turn impact investment prices across asset classes.

In energy markets, oil prices showed minimal movement early Tuesday. Benchmark U.S. crude dipped 4 cents to $62.10 per barrel, while Brent crude, the international standard, decreased 13 cents to $66.17 per barrel.

Currency markets saw the U.S. dollar slightly weaken against the Japanese yen, trading at 155.52 yen compared to 155.61 yen. The euro strengthened to $1.1819 from $1.1791.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

12 Comments

Global markets seem to be regaining their footing after a period of uncertainty. It will be interesting to see if this rally can be sustained in the long run.

Interesting to see global markets regaining momentum, particularly in tech hubs like Japan and South Korea. Curious to see if the expected LDP victory will indeed usher in more market-friendly policies.

The new record highs for the Nikkei 225 are certainly impressive. I’m curious to see if this momentum can be maintained, especially with the potential policy changes on the horizon.

A 7% surge in the Kospi is quite remarkable. I wonder what factors are driving this resurgence in investor confidence, beyond the broader regional trends.

The new highs in the Nikkei 225 and Kospi are certainly eye-catching. It will be interesting to see how this momentum translates to other global markets in the coming weeks.

It’s encouraging to see the South Korean market bounce back after worries about an AI bubble. The tech sector’s leading role in the rally is a positive sign.

The surge in Asian indices is quite remarkable. I wonder how sustainable this rally will be, given concerns over the potential weakening of the yen and its impact on certain sectors.

Good point. The currency implications will be important to monitor, as a weaker yen could create challenges for some businesses and consumers.

The potential policy changes in Japan are an intriguing factor to watch. I’m curious to see how they might impact different sectors and the overall market dynamics.

The performance of equipment manufacturers and testing companies in Japan is noteworthy. This could indicate strong demand in the tech supply chain.

Overall, this seems to be a broad-based rally across Asia, with both Japan and South Korea posting impressive gains. The underlying drivers will be important to understand.

The resurgence of investor confidence in South Korea’s tech sector is a positive sign. However, the potential for an AI bubble is still a concern that bears monitoring.