Listen to the article

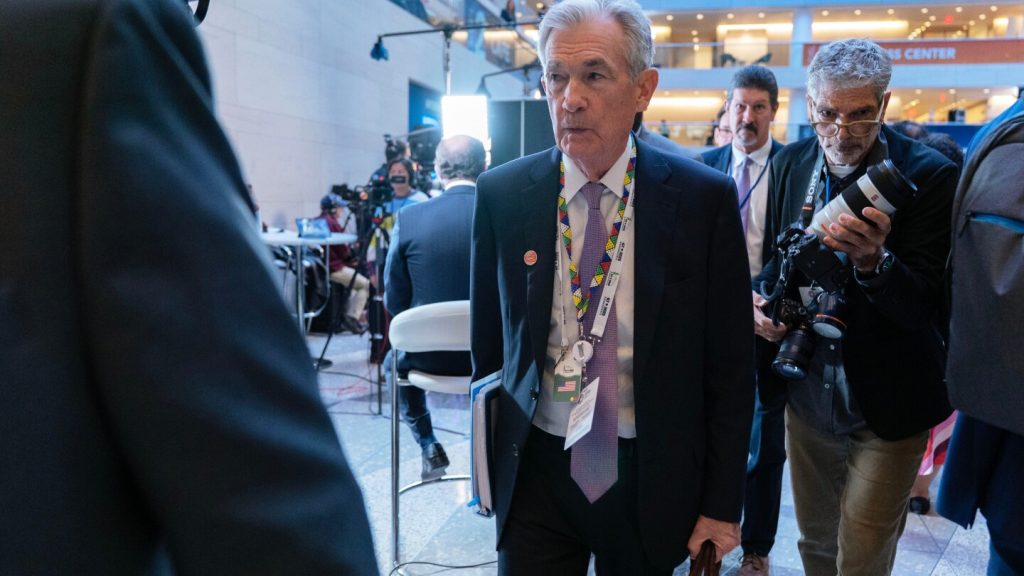

The Federal Reserve is poised to cut its key interest rate on Wednesday, marking the second reduction this year as the central bank navigates an increasingly complex economic landscape. Analysts widely expect the Fed to lower rates from the current 4.1% to approximately 3.9%, with signals potentially pointing to another cut in December.

The anticipated rate reduction comes as the Fed attempts to address mounting concerns about a slowdown in hiring while still monitoring inflation levels that remain above its 2% target. Since Fed Chair Jerome Powell signaled in late August that rate cuts were on the horizon, mortgage rates have already begun to respond, with the average 30-year fixed rate falling from 6.6% to about 6.2%, providing a much-needed boost to the housing market.

“The labor market has actually softened pretty considerably,” Powell said in recent remarks. “The downside risks to employment appear to have risen.”

Employment data has indeed shown troubling signs. Prior to the government shutdown that began October 1, monthly hiring had slowed dramatically to an average of just 29,000 jobs over the previous three months. The unemployment rate, while still relatively low at 4.3%, has been trending upward.

Powell has described the current job market as being in a “curious kind of balance,” referring to what Fed officials characterize as a “low-hire, low-fire” environment where new hiring has nearly ground to a halt but layoffs remain minimal.

Complicating the Fed’s decision-making is the ongoing government shutdown, which has interrupted the flow of critical economic data. The September jobs report has been postponed, and the White House has indicated that October’s inflation figures may not even be compiled. This lack of data creates significant uncertainty for policymakers.

“Imagine you’re driving in a winter storm and suddenly lose visibility in whiteout conditions,” explained Kris Dawsey, head of economic research at D.E. Shaw, an investment bank. “While you slow the car down, you’re going to continue going in the direction you were going versus making an abrupt change once you lose that visibility.”

The shutdown itself poses additional economic risks. Approximately 750,000 federal workers are approaching a month without pay, which could soon begin to weaken consumer spending—a vital driver of economic growth.

Meanwhile, the broader economy presents a puzzling picture. While job growth has stalled, the overall economy continues to expand at a healthy pace, fueled in part by massive investments from leading tech companies in artificial intelligence infrastructure.

This contradiction has prompted some Fed officials, including Christopher Waller, a member of the Fed’s governing board, to urge caution beyond the October meeting. “Either economic growth softens to match a soft labor market, or the labor market rebounds to match stronger economic growth,” Waller said in a recent speech. While supporting the October cut, he emphasized that future decisions would depend heavily on incoming economic data.

At its September meeting, the Fed projected three rate cuts for 2023, though the policymaking committee remains divided, with nine of 19 officials supporting two or fewer reductions. Despite this internal disagreement, financial markets have assigned more than 90% probability to another rate cut in December, according to CME FedWatch.

For consumers, these rate cuts could translate to lower borrowing costs for mortgages, auto loans, and credit cards. However, the full economic impact remains uncertain, particularly as the government shutdown continues and economic data becomes more limited.

Jonathan Pingle, chief U.S. economist at UBS, notes that Powell’s post-meeting press conference will be closely watched for clues about the December meeting. “If I hear that [Powell repeating concerns about labor market weakness], I think they’re on track to lowering rates again in December,” he said.

As the Fed attempts to steer the economy through these challenging conditions, its primary goal is to move its key rate closer to a level that would neither impede nor stimulate economic growth—a delicate balance in an environment where traditional economic indicators are sending mixed signals.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

22 Comments

The cost guidance is better than expected. If they deliver, the stock could rerate.

Good point. Watching costs and grades closely.

Production mix shifting toward Business might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Production mix shifting toward Business might help margins if metals stay firm.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Exploration results look promising, but permitting will be the key risk.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

The cost guidance is better than expected. If they deliver, the stock could rerate.

Interesting update on Federal Reserve likely to cut key rate Wednesday and may signal another cut to follow. Curious how the grades will trend next quarter.

Nice to see insider buying—usually a good signal in this space.

Exploration results look promising, but permitting will be the key risk.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.