Listen to the article

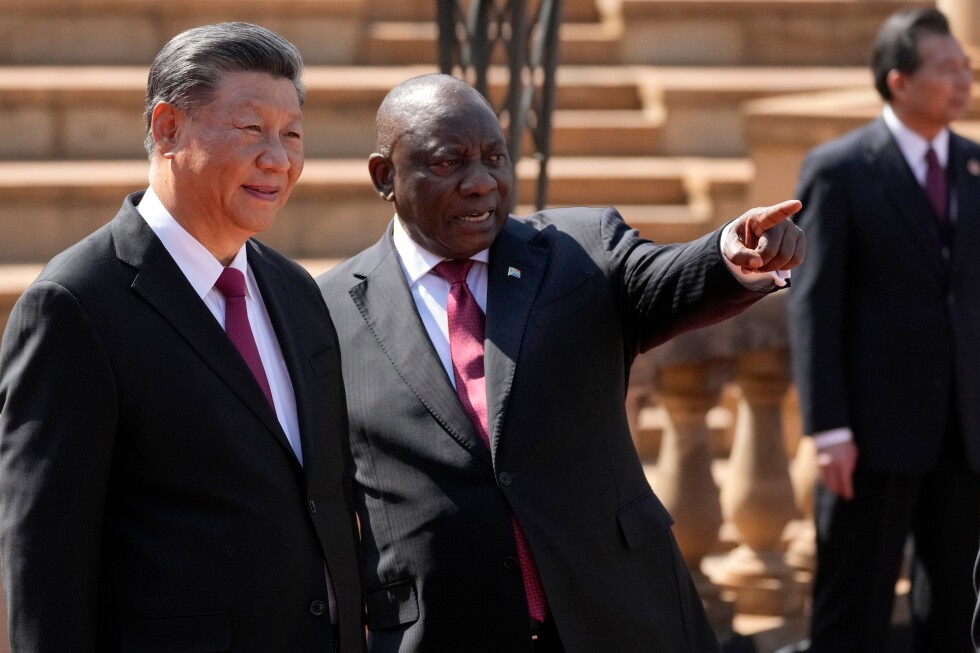

China and South Africa inked a framework agreement Friday to begin negotiations on a new trade deal, as Pretoria seeks to diversify its economic partnerships amid escalating tensions with the United States.

The agreement, announced by South Africa’s Ministry of Trade and Industry, aims to give South African goods, particularly agricultural products like fruit, duty-free access to the massive Chinese consumer market. Officials expect the deal to be finalized by the end of March.

In exchange, China will receive enhanced investment opportunities in South Africa, where Chinese automakers have already made significant inroads. Industry analysts note that Chinese car brands have rapidly expanded their presence in the South African market, growing from just 2.8% market share in 2020 to between 11% and 15% last year.

The timing of this trade agreement is significant, coming shortly after the U.S. imposed 30% tariffs on certain South African imports under President Donald Trump’s reciprocal tariffs policy—among the highest rates applied globally. While South African officials say they continue to negotiate with Washington for better terms, the move toward China signals Pretoria’s determination to secure alternative trade partnerships.

“South Africa looks forward to working with China in a friendly, pragmatic and flexible manner,” the trade ministry stated in its announcement.

Trade and Industry Minister Parks Tau, who traveled to China to sign the framework agreement, highlighted that the deal would benefit multiple sectors of the South African economy, including mining, agriculture, renewable energy, and technology.

The agreement comes as diplomatic relations between South Africa and the United States have deteriorated to their lowest point in decades. The Trump administration has accused South Africa of pursuing anti-American foreign policies and has made controversial claims about the persecution of white Afrikaner farmers—allegations the South African government has firmly rejected as baseless.

In a further blow to bilateral relations, the U.S. has excluded South Africa from participating in this year’s G20 meetings being hosted in the United States.

China is already South Africa’s largest trading partner for both imports and exports. South Africa primarily exports gold, iron ore, and platinum-group metals to China—resources crucial for technology manufacturing and industrial production. Chinese economic influence extends well beyond South Africa, with Beijing establishing dominant positions in the extraction of critical minerals across the African continent that are essential components for high-tech products and renewable energy technologies.

The Chinese electric vehicle manufacturer BYD, which overtook Tesla as the world’s largest electric vehicle producer in 2025, exemplifies China’s growing industrial might and its strategic focus on next-generation technologies and markets.

The announcement also follows the Trump administration’s short-term renewal of the African Growth and Opportunity Act (AGOA), a longstanding free-trade agreement between the U.S. and African nations. The extension lasts only until the end of the year, with indications that future versions will be modified to align with the administration’s America First policy priorities.

This shift in South Africa’s trade strategy reflects a broader trend among nations seeking alternatives to U.S. partnerships as Trump’s aggressive trade policies reshape global economic relationships. Analysts suggest that China’s expanding economic footprint in Africa could further diminish U.S. influence across the continent, particularly in securing access to the strategic minerals necessary for the green energy transition and advanced manufacturing.

For South Africa, diversifying its trade relationships provides some insulation from geopolitical tensions while potentially opening new markets for its exports at a time when its domestic economy faces significant challenges, including high unemployment and infrastructure constraints.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

16 Comments

Production mix shifting toward Business might help margins if metals stay firm.

Good point. Watching costs and grades closely.

Production mix shifting toward Business might help margins if metals stay firm.

Exploration results look promising, but permitting will be the key risk.

Silver leverage is strong here; beta cuts both ways though.

If AISC keeps dropping, this becomes investable for me.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

Silver leverage is strong here; beta cuts both ways though.

Good point. Watching costs and grades closely.

I like the balance sheet here—less leverage than peers.

Good point. Watching costs and grades closely.

Good point. Watching costs and grades closely.

If AISC keeps dropping, this becomes investable for me.

Production mix shifting toward Business might help margins if metals stay firm.

Exploration results look promising, but permitting will be the key risk.