Listen to the article

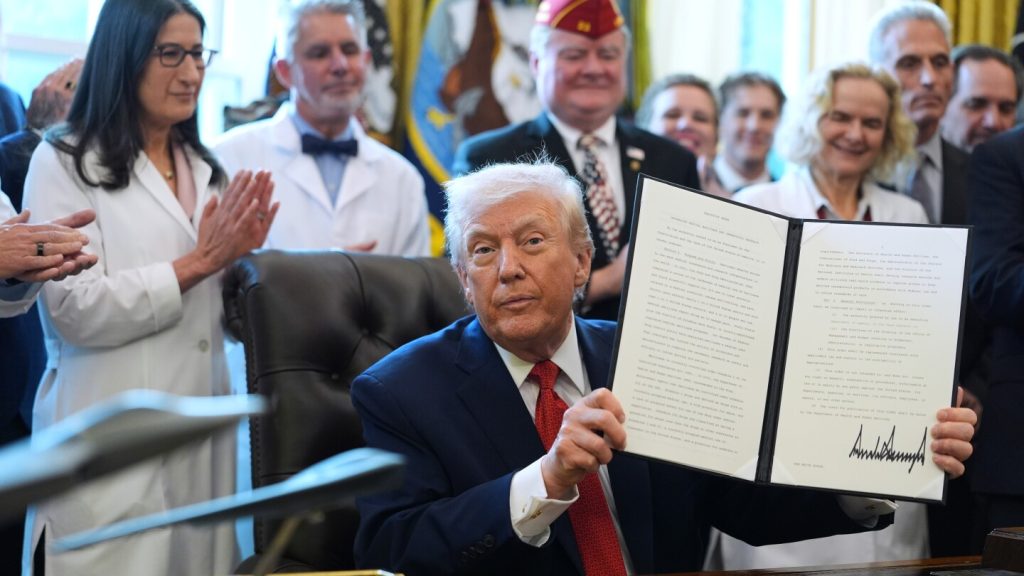

Cannabis stocks saw mixed reactions Thursday following President Donald Trump’s executive order aimed at expediting the reclassification of marijuana under federal law, a move that could fundamentally reshape the industry’s regulatory landscape.

The executive order directs the Drug Enforcement Administration to accelerate the process of moving cannabis from its current Schedule I classification—where it sits alongside substances like heroin and LSD—to Schedule III, which includes drugs like ketamine and certain anabolic steroids. While the reclassification doesn’t legalize recreational use nationally, it represents a significant easing of federal restrictions.

Despite initial enthusiasm in the days leading up to the announcement, many cannabis stocks retreated following the actual news. Tilray Brands, one of the sector’s most prominent players, fell 4.2% to $12.33 on Thursday. While the stock remains far below its 2018 IPO price of $17, it has surged more than 50% in December as investors anticipated regulatory reform.

Canadian producer Canopy Growth dropped 12.5% on the Toronto Stock Exchange, though it has still gained over 40% this month. Curaleaf Holdings experienced an even steeper decline, falling 32% in Thursday trading, but maintains a 30% gain for December. Similarly, Roundhill Investments’ cannabis ETF tumbled 26.8% on the day but remains up more than 40% for the month.

“This is classic ‘buy the rumor, sell the news’ behavior,” explained Jonathan Sandelman, CEO of cannabis investment firm Mercer Park. “The market had been pricing in some form of federal action for weeks. What we’re seeing now is profit-taking combined with a reassessment of the timeline for meaningful operational benefits.”

The cannabis industry has navigated challenging terrain in recent years. Despite growing state-level legalization—with 24 states now permitting recreational use and 38 allowing medical use—federal prohibition has created significant obstacles for companies operating in the space.

Under current Schedule I status, cannabis businesses face severe tax disadvantages, notably Section 280E of the Internal Revenue Code, which prevents them from deducting ordinary business expenses. This provision alone has increased effective tax rates to 70% or higher for many operators, according to industry analysts.

“Rescheduling to Schedule III would effectively eliminate 280E for cannabis companies, potentially increasing profitability by 10 to 15 percentage points overnight,” said Pablo Zuanic, cannabis analyst at Cantor Fitzgerald. “For an industry operating on thin margins, that’s transformative.”

Beyond tax relief, reclassification could significantly expand research opportunities. Schedule I restrictions have severely limited clinical studies of cannabis, hampering both medical advancement and product development. Under Schedule III, researchers would face fewer bureaucratic hurdles in studying the plant’s effects and potential applications.

Perhaps most critically for the industry’s financial health, the regulatory shift could encourage greater participation from traditional banking and investment institutions. Major banks and payment processors have largely avoided the industry due to federal prohibition, forcing cannabis companies to operate primarily in cash and limiting their access to capital.

“The banking situation has been one of our biggest operational headaches,” said Kim Rivers, CEO of Trulieve Cannabis. “Rescheduling won’t immediately solve everything, but it removes a significant barrier to financial normalization.”

Industry experts caution that meaningful implementation of the executive order could take months or even years, as the DEA must follow established administrative procedures. The agency began a review of marijuana’s classification earlier this year following a recommendation from the Department of Health and Human Services.

While Thursday’s market reaction suggests investors are taking a wait-and-see approach, the executive order represents the most significant federal cannabis reform initiative in decades, potentially setting the stage for more comprehensive legislative action in the future.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

6 Comments

Reclassifying cannabis from Schedule I to Schedule III is a significant move that could open up new opportunities for medical and recreational use. However, the market’s mixed reaction shows there’s still work to be done to provide clarity and stability for the industry.

The potential reclassification of cannabis is an important development, but the industry remains in a state of flux. Investors will be closely watching for any further regulatory changes and their impact on cannabis companies’ operations and profitability.

The cannabis industry has faced a lot of regulatory uncertainty, so any steps towards federal reclassification and easing of restrictions are welcome. However, the devil will be in the details, and I’m curious to see how the process unfolds and impacts companies like Tilray and Canopy Growth.

The cannabis industry has been eagerly awaiting regulatory reforms at the federal level. This executive order could be a step in the right direction, but there’s still a lot of uncertainty around the implementation and timelines.

Interesting move by the Biden administration to expedite the reclassification of cannabis. This could unlock significant growth opportunities for the industry, but the market’s mixed reaction shows investors are cautious about the details and implementation.

While the potential reclassification of cannabis is positive news, it’s not surprising to see some volatility in the sector’s stock prices. Investors will likely wait for more clarity on the regulatory changes before making major bets on cannabis companies.