Listen to the article

Treasury Secretary Dodges Commitment on Fed Independence Amid Trump’s Threats

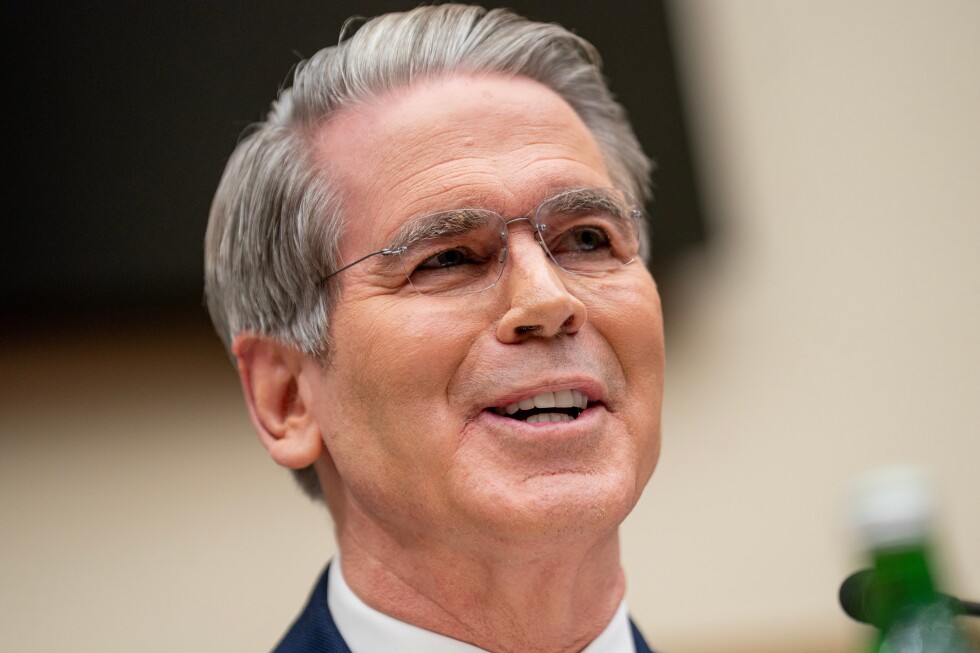

Treasury Secretary Scott Bessent declined to guarantee that Donald Trump’s Federal Reserve chair nominee Kevin Warsh would be free from legal threats if he refuses to lower interest rates, telling lawmakers that such decisions would be “up to the president.”

The exchange occurred during a tense Senate Banking Committee hearing on Wednesday, where Democratic Senator Elizabeth Warren pressed Bessent to commit that Warsh would not face lawsuits or Justice Department investigations for monetary policy decisions.

“That is up to the president,” Bessent replied, prompting a heated exchange as Warren expressed astonishment at his unwillingness to defend the Fed’s independence.

The controversy stems from remarks Trump made during a private black-tie dinner at the elite Alfalfa Club on Saturday night, where he suggested he might sue his newly selected Fed chair nominee if Warsh doesn’t cut interest rates. When questioned by reporters afterward, Trump dismissed his comments as comedic, saying, “It’s a roast. It was all comedy.”

However, the comments have heightened concerns about the Trump administration’s respect for the Federal Reserve’s traditional independence from political pressure. These fears are particularly acute given Trump’s treatment of current Fed Chair Jerome Powell, whom Trump appointed in 2017 but quickly turned against when Powell raised interest rates the following year.

Trump has consistently criticized Powell since returning to office, and last month, Powell revealed that the Department of Justice had subpoenaed the Federal Reserve as part of an investigation into his Senate testimony about a $2.5 billion Fed building renovation.

The investigation has alarmed some Republican lawmakers. Senator Thom Tillis of North Carolina, who is retiring at year-end, has declared he won’t support Warsh’s nomination until the Powell investigation is resolved—potentially stalling the nomination in committee.

“Even stipulating that that could happen and that it’s not a bad idea is troubling to me,” Tillis said regarding Bessent’s remarks about the possibility of Trump suing Warsh.

During Wednesday’s hearing, Tillis submitted a list of committee members who saw no criminal intent in Powell’s actions. “I was actually a witness at the alleged scene of the crime,” Tillis stated. “We didn’t see a crime.”

Senator Tim Scott of South Carolina, the Republican who chairs the Banking Committee, also broke ranks with the administration, telling Fox Business, “Ineptness or being incompetent is not a criminal act.”

The clash highlights growing tensions between the executive branch and lawmakers concerned about maintaining the Fed’s independence. The central bank’s ability to make monetary policy decisions free from political pressure has long been considered crucial to economic stability.

Wednesday marked the second consecutive day of hearings for Bessent regarding the annual report by the Financial Stability Oversight Council. His appearance before the House Financial Services Committee a day earlier reportedly devolved into confrontation, with Bessent clashing with Democratic lawmakers over fiscal policy, Trump family business dealings, and other contentious issues.

Financial markets remain attentive to these developments, as any perception that the Federal Reserve might lose its independence could trigger volatility. Economists widely consider central bank independence essential for effective inflation control and economic stability.

The episode represents the latest in a series of challenges to institutional norms surrounding the Federal Reserve. Analysts note that politicizing monetary policy decisions could undermine confidence in the dollar and U.S. financial markets, which benefit from the perception that Fed decisions are made on economic rather than political grounds.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

15 Comments

The Fed’s independence is essential for maintaining financial stability and public trust. Efforts to undermine that independence are highly problematic.

Interesting to see the tensions between the Trump administration and the Fed. Safeguarding the central bank’s independence should be a bipartisan concern.

This saga highlights the fine line the Fed must walk between making data-driven decisions and avoiding political interference. Maintaining credibility is crucial.

The Treasury Secretary’s evasive response is not very reassuring. Defending the Fed’s independence should be a top priority for the administration.

Threatening legal action against a Fed nominee over interest rates seems like a dangerous precedent. The central bank needs to operate free from political pressure.

Absolutely. The Fed has to make decisions based on economic conditions, not political agendas. Anything else puts the whole financial system at risk.

I’m curious to see how this plays out. The Trump administration appears to be taking a more confrontational stance towards the Fed compared to past presidents.

Yes, it’s a concerning development. The Fed’s credibility and independence are vital for maintaining economic stability and public confidence.

Threatening legal action against a Fed nominee for interest rate decisions is an unprecedented and troubling move. The central bank’s independence must be protected.

Interesting to see the Treasury Secretary dodge a direct commitment on Fed independence. This could be a concerning sign of political influence over monetary policy decisions.

Agreed. The Fed’s independence is crucial for maintaining credibility and stability. Any hint of political interference would undermine public trust.

This seems like a worrying trend of the executive branch trying to exert influence over monetary policy. The Fed must remain independent to do its job effectively.

I agree. Any erosion of the Fed’s independence could have serious consequences for the economy. This bears close watching going forward.

While the Fed’s actions can be controversial, they must be allowed to operate without fear of legal retaliation. This is a concerning development.

Agreed. The Fed needs to make decisions based on economic conditions, not political considerations. Any erosion of its independence is worrying.