Listen to the article

California’s Proposed Billionaire Tax Creates Democratic Divide Ahead of Midterms

A proposed California tax on billionaires is driving a wedge between prominent Democrats at a critical time, as the party seeks unity ahead of the November midterm elections. The measure has placed Senator Bernie Sanders and Governor Gavin Newsom on opposite sides of a heated debate that could have far-reaching implications for the state’s economy and political landscape.

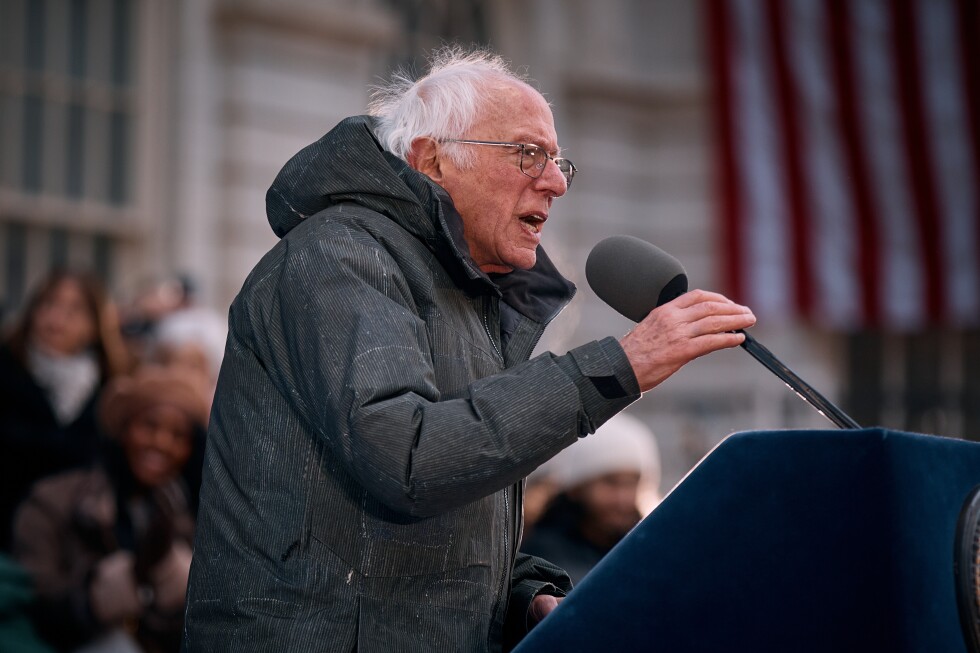

Sanders is scheduled to hold a rally Wednesday afternoon in Los Angeles to drum up support for the controversial proposal, which would impose a one-time 5% tax on billionaires’ assets, including stocks, businesses, art, collectibles, and intellectual property. The Vermont senator, who won California’s 2020 Democratic presidential primary by a substantial margin, has long advocated against wealth inequality.

“Our nation will not thrive when so few own so much,” Sanders wrote on social media platform X, adding that he “strongly supports” the tax “at a time of unprecedented and growing wealth and income inequality.”

The tax proposal, backed by a large healthcare union, aims to compensate for federal funding cuts to health services for lower-income Californians that were implemented during the Trump administration. For supporters, it represents a necessary measure to protect vulnerable populations while addressing the growing wealth gap.

However, Governor Newsom has emerged as one of the proposal’s most vocal opponents. The Democratic governor, who is rumored to be considering a 2028 presidential run, has consistently opposed state-level wealth taxes, arguing they would put California at a competitive disadvantage nationally and potentially trigger a billionaire exodus that could devastate state finances.

“The issues that are really going to be motivating Democrats this year, affordability and the cost of health care and cuts to schools, none of these would be fixed by this proposal. If fact, they would be made worse,” explained Brian Brokaw, a longtime Newsom adviser who leads a political committee opposing the tax.

The disagreement highlights a broader ideological divide within the Democratic Party as it attempts to maintain control of the Senate and recapture the House in November. Political analysts suggest the party would benefit from focusing on issues where Democrats stand united and Republicans are divided—not the opposite.

“It is always better for a party to have the political debate focused on issues where you are united and the other party is divided,” noted Eric Schickler, a political science professor at the University of California, Berkeley. “Having an issue like this where Newsom and Sanders—among others—are on different sides is not ideal.”

The proposal has already sent shockwaves through Silicon Valley, with some tech titans threatening to leave California if the tax is implemented. Financial analysts warn that an exodus of billionaires could cost the state hundreds of millions in tax revenue at a time when California is already facing budget constraints.

The debate is unfolding against a backdrop of widespread economic anxiety among voters across the political spectrum. Polls consistently show Americans expressing concern about economic conditions and distrust in government’s ability to effectively address these issues.

The tax proposal has quickly filtered into other political races across the state. Republican gubernatorial candidates Chad Bianco and Steve Hilton have warned the tax would eliminate jobs, while Democratic San Jose Mayor Matt Mahan, also running for governor, has suggested inequality should be addressed at the federal level through tax code reforms.

For the measure to appear on the November ballot, supporters must gather more than 870,000 petition signatures. The effort has already attracted significant financial contributions to political committees on both sides of the issue, setting the stage for what could be a costly and divisive campaign.

As Sanders prepares to rally supporters in Los Angeles, and with the state Democratic convention approaching this weekend, opponents are intensifying their efforts to sway party insiders through targeted emails and social media campaigns.

The outcome of this intra-party conflict could have significant implications for Democrats’ midterm strategy in California, where redistricting has created opportunities for the party to gain as many as five additional House seats—potentially crucial in their efforts to regain control of the chamber.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

6 Comments

As an investor, I’ll be watching this closely. A tax on billionaires’ assets could have ripple effects on the markets and the broader economy. I wonder how it might affect investment and business decisions in the state.

Good point. Depending on the specifics, this could make California a less attractive place for high-net-worth individuals and businesses. That’s a risk that needs to be carefully weighed.

Interesting to see the political divide over this proposed billionaire tax in California. It’ll be fascinating to see how the debate plays out between Sanders and Newsom, two prominent Democrats with different views on this issue.

I can understand both sides of the argument. Wealth inequality is a major issue, but a tax like this could have unintended consequences for the state’s economy.

I’m curious to hear more details on how this tax would work in practice and what the potential impacts could be, both positive and negative. It’s a complex issue without easy solutions.

Absolutely, the devil will be in the details. I hope the debate can focus on the facts and data rather than just partisan posturing.