Listen to the article

The battle for a small chipmaker is threatening global auto production, with signs of resolution starting to emerge as geopolitical tensions between China and the West play out across the semiconductor supply chain.

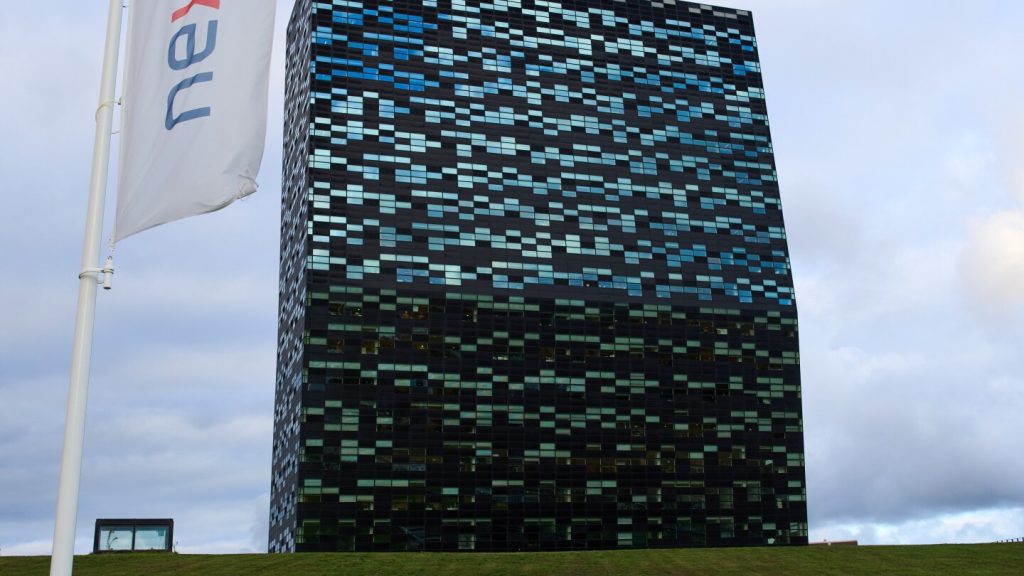

A power struggle over Nexperia, a Chinese-owned Dutch semiconductor manufacturer, has rippled through automotive supply chains globally, forcing Honda to halt production at its Mexican factory that produces the popular HR-V crossover for North American consumers. The dispute exemplifies how Europe is caught in the broader technological confrontation between Washington and Beijing.

The crisis became public in mid-October when Dutch authorities revealed they had invoked a rarely used World War II-era law to effectively take control of Nexperia weeks earlier. The Dutch economic affairs ministry cited national security concerns, pointing to “serious governance shortcomings” that threatened to drain crucial technological expertise from Europe.

At the center of the dispute is Wingtech Technology, Nexperia’s Chinese parent company that purchased the chipmaker for $3.6 billion in 2018. Wingtech, which is partially state-owned, found itself at odds with Dutch authorities who successfully petitioned a court to remove Nexperia’s Chinese CEO Zhang Xuezheng. Court filings revealed that American officials had indicated to the Dutch government that Zhang’s replacement was necessary to avoid trade restrictions.

Nexperia, headquartered in Nijmegen, Netherlands, produces essential semiconductors such as switches and logic chips used extensively throughout modern vehicles. Its components control adaptive LED headlights, manage electric vehicle battery systems, and enable anti-lock brakes, among numerous other applications.

The company’s manufacturing footprint spans multiple continents, with wafer fabrication facilities in Britain and Germany. Crucially, it operates an assembly and testing center in China’s Guangdong province that accounts for approximately 70% of its finished product capacity, alongside similar facilities in the Philippines and Malaysia.

This dispute is embedded in the broader U.S.-China technological rivalry. Washington placed Wingtech on its “entity list” late last year, imposing export controls due to national security concerns. In September, the U.S. expanded these restrictions to include Wingtech’s subsidiaries, including Nexperia, and pressured allies to follow similar measures.

Beijing retaliated after the Dutch takeover by blocking exports of Nexperia chips from its assembly plant in Dongguan, accusing the Netherlands of creating “turmoil and chaos” in semiconductor supply chains. A glimmer of hope emerged following last month’s meeting between U.S. President Donald Trump and Chinese leader Xi Jinping, when both sides indicated Beijing would ease the export ban as part of a broader trade agreement.

However, complications persisted as Nexperia’s Chinese unit reported that headquarters had suspended shipments of wafers – essential materials for chip production – to its Chinese factory. Nexperia’s head office countered that the Chinese unit had refused to pay for these wafers and was “ignoring lawful instructions” from global management. The company warned it couldn’t guarantee the quality of any chips delivered from its China facility since mid-October.

The impact on the automotive industry has been significant. Despite representing only about 5% of the automotive silicon discrete market by revenue, Nexperia’s share of chip volume is considerably higher, according to S&P Global Mobility analysts. Modern vehicles often contain dozens to hundreds of Nexperia’s components across various systems, leaving automakers in North America, Japan, and South Korea particularly vulnerable.

Industry leaders have voiced serious concerns. Ford CEO Jim Farley described it as “an industrywide issue” requiring “a quick breakthrough to avoid fourth quarter production losses.” General Motors CEO Mary Barra warned of potential production impacts, noting teams were “working around the clock” to minimize disruptions. Nissan set aside 25 billion yen ($163 million) partly to absorb the impact of the Nexperia crisis.

European automakers have also felt the pressure. Mercedes-Benz CEO Ola Kallenius said the company was “scurrying around the world” for alternatives. The European Automobile Manufacturers’ Association reported that members including BMW, Renault, Volkswagen, and Volvo were depleting chip stockpiles and warned of assembly line stoppages if supplies ran out.

Signs of resolution have begun to emerge. European Union Trade Commissioner Maros Sefcovic noted “encouraging progress,” with China’s Commerce Ministry confirming “further simplification” of export procedures. The ministry also agreed to a Dutch request to send representatives to China for consultations, though it pointed out that the Netherlands had yet to take “concrete actions” to restore the supply chain.

Honda received word that Nexperia’s shipments from China had resumed and expects to restart production at its Celaya, Mexico plant, which can produce up to 200,000 vehicles annually, by November 21.

Fact Checker

Verify the accuracy of this article using The Disinformation Commission analysis and real-time sources.

10 Comments

This is a complex situation with geopolitical tensions at play. Securing critical semiconductor supply chains is vital, but it’s concerning to see disruptions to automakers like Honda. I wonder what the long-term implications will be for Europe’s tech sector.

You raise a good point. Maintaining technological sovereignty is crucial, but these disputes can have far-reaching consequences. It will be interesting to see how this plays out and what compromises or solutions emerge.

The Nexperia saga shows how quickly semiconductor supply chain disruptions can cascade through industries like automotive. Resolving these issues requires cooperation and compromise between nations and companies. I hope cooler heads can prevail.

Semiconductor manufacturing is a strategic industry, so it’s not surprising to see geopolitical tensions play out in this Nexperia case. Maintaining access to critical technology will be an ongoing challenge, but knee-jerk protectionism isn’t the answer either.

Exactly. There needs to be a balanced approach that protects national security interests while also preserving the benefits of an integrated global supply chain. It’s a delicate balance, but getting it right is crucial.

This situation underscores the importance of semiconductor manufacturing and the strategic value of tech companies. It’s a complex issue with no easy answers, but maintaining a stable, secure supply of crucial components is vital for the global economy.

Well said. Semiconductors are the foundation of so many industries, and ensuring their reliable supply is a major challenge. Balancing national interests with global interdependence will require nuanced policymaking.

Chipmaking is so crucial for modern industries, from cars to consumer electronics. This Nexperia saga underscores the fragility of global supply chains and the need for resilience, especially in strategic sectors. I hope Dutch authorities can find a balanced approach.

Absolutely. Semiconductor supply chain disruptions can ripple through the entire economy. Finding the right balance between national security concerns and maintaining an open, interconnected global market will be a delicate challenge.

The battle over Nexperia is a stark reminder of the geopolitical dimensions of the semiconductor industry. As technology and trade become increasingly intertwined, we’ll likely see more of these types of disputes. Careful diplomacy and pragmatic solutions will be key.